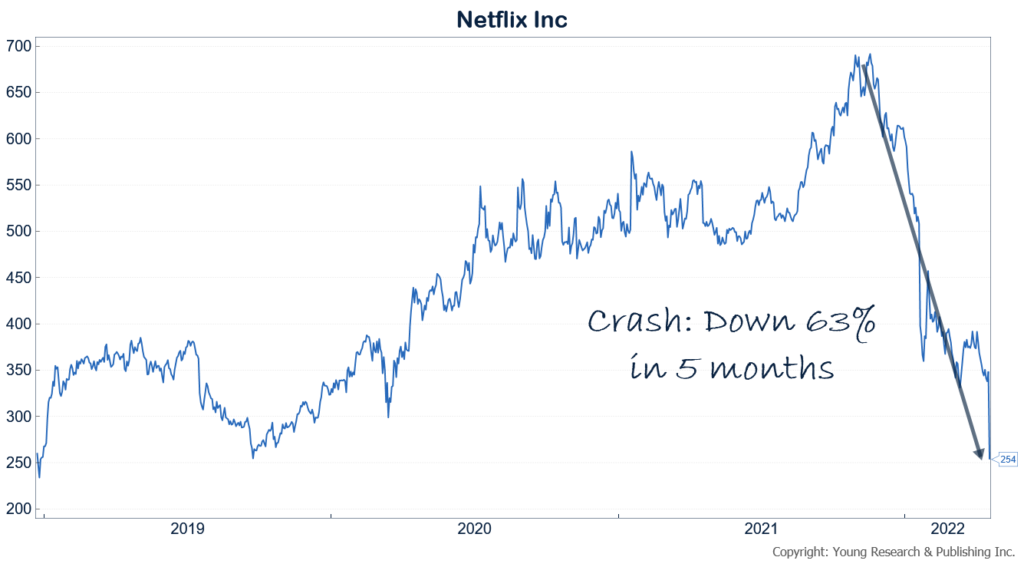

The bust in high growth stocks continues to spread with shares of Netflix down 25% in pre-market trading. According to its most recent earnings report, Netflix has lost subscribers for the first time in ten years. Since hitting a peak in November of last year, that’s 5 months ago, Netflix shares are down 63%. How did a company with a market value of over $300 billion and bigger than Exxon, Disney, and Verizon crash so hard? Inflated expectations and an inflated valuation.

Netflix was trading at over 50X earnings in November. When growth starts to slow or even reverse at companies trading at ultra-high valuations, the outcome can be disastrous for investors. Five years of 27% compounded annual sales growth and 91% earnings growth (which is 4X the sales growth and 7X the earnings growth of the S&P 500 over the same period) has now resulted in a five-year return that is less than the S&P 500.

Read more on alternative strategies to Netflix here, and here.

Harriet Clarfelt reports on Netflix’s crash at the Financial Times, writing:

California-based Netflix said late on Tuesday that its decade-long run of subscriber growth had drawn to an end in the first quarter of 2022 and that it had become “harder to grow membership” in many markets.

In an earnings update the streaming company projected that subscriber numbers would drop by another 2mn in the current quarter, having already fallen about 200,000 in the previous three months.

Netflix shares lost as much as 30 per cent after the opening bell on Wednesday.

The “sea-change quarter” prompted JPMorgan to cut its recommendation on Netflix from “overweight” to “neutral”, with analysts at the US bank flagging up concerns over account sharing, market saturation and mounting competition.

Netflix’s announcement also hit the shares of other television and film subscription companies. Walt Disney, owner of the Disney Plus streaming service, fell more than 4 per cent, while streaming platform and hardware business Roku dropped about 7 per cent. Music streaming service Spotify slid more than 7 per cent.

Streaming services and stay-at-home stocks had “lost a lot of value over the last few months”, said Patrick Armstrong, chief investment officer at Plurimi Group. “The market was expecting this but nobody expected the [Netflix] subscriber losses to be as dramatic as they were.”