In the spirit of kicking somebody while he is down, check out the Facebook chart below. Facebook has been on the hot seat for a number of reasons, as you are likely aware. Chief among those reasons, but unsaid explicitly by the media, is that Facebook is responsible for the Donald Trump presidency.

Take away the emotion of the issue and it is obviously far-fetched. But the recent Cambridge Analytica issue has provided more oxygen for the fire. Facebook’s response to the scrutiny has been embarrassing. Watch some of Zuckerberg’s CNN interview and ask yourself if this is a guy who should be the head of one of America’s biggest companies.

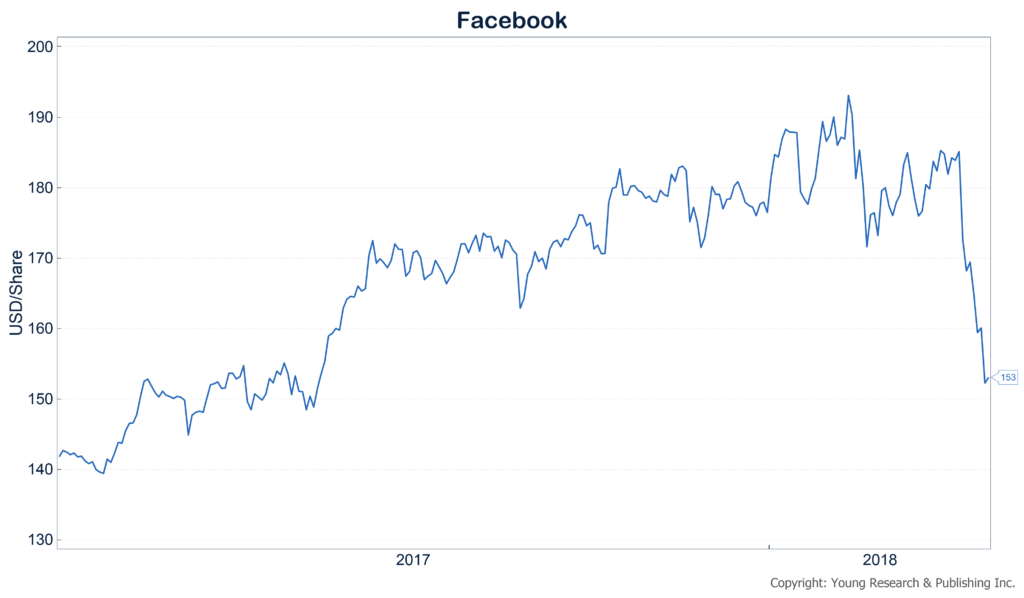

The heat on Facebook, along with some backlash against social media in general has taken the wind out of the company’s sails as should be evident from the stock price. Facebook is down -13.28% YTD.

Could this be a buying opportunity? Indeed it could, but not for our money? Facebook generates a ton of cash, but the sustainability of that cash stream is uncertain in our view. The risk of disruption may be much bigger than Facebook bulls believe. Don’t forget, the dominant social network in America was disrupted not once when Facebook killed off Myspace, but by our count also when Facebook mobile disrupted the desktop version of Facebook and when Instagram (now owned by Facebook) became more popular with many Americans.

One might then put the probability that a dominant social network gets disrupted at 75%. That sounds much closer to speculation than investment. As does the fact that Facebook allows management (headed by Zuckerberg) to reinvest billions in cash flow without paying a dividend to shareholders. Oh, and did I mention the A/B structure that puts all the voting power in Zuckerberg’s hands? No thanks.