Barron’s thinks so. MLPs have long been a sector of focus at Young Research. Here Barron’s makes the case for taking another look at MLPs. We would agree, though investors should be sure to separate the fish from the fowl (yes there are some fowl in the MLP universe) as we do for subscribers to Intelligence Report.

Many investors who exited energy-focused master limited partnerships earlier this year as oil prices crashed and MLP prices fell even harder, have struggled with when—and if—to get back in. The sector rebounded sharply off its February lows, but since June, gains have stalled as investors judged the easy money had been made and risks outweighed the opportunity.

It’s time to take another look at the sector. MLPs, which yield over 7% on average, are still plenty risky and are not the stable, tax-deferred “toll takers” many investors once thought. But the biggest risks are fading, and, as third-quarter earnings season kicks off, there’s potential upside. “The tone has changed,” says Marcus McGregor, who runs MLP strategy at Conning. “Investors are more comfortable with energy and are noticing, by the way, interest rates are still low and MLP yields are attractive.”

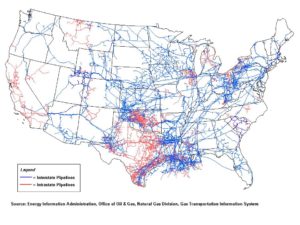

Energy prices are not only higher, but are more stable. Crude is near $51, high enough for many U.S. producers to operate profitably, and rig counts are rising. That should lead to more oil and gas volume that needs to be transported through MLP pipes.