Investing in the bond market has been a tough slog over the last few years. Zero percent policy rates and bond buying by the world’s major central banks has kept yields at some of the lowest levels on record. Investors have long had an aversion to the bond market. Bonds don’t offer the glamour and hope that many crave from their investments. And bonds don’t provide the kind of long-term upside that stocks can. Add today’s ultra-low yields to the investing public’s natural bias against bonds, and the result is a move by some investors to load up on stocks in an effort to boost income.

Higher yields are indeed available in the stock market, but you don’t buy bonds solely for income. Bonds give you the courage to own stocks. They are also a powerful counterbalancer. When stocks fall, bonds often rise. For retired investors drawing an income from their portfolio, bonds provide a necessary stabilizer.

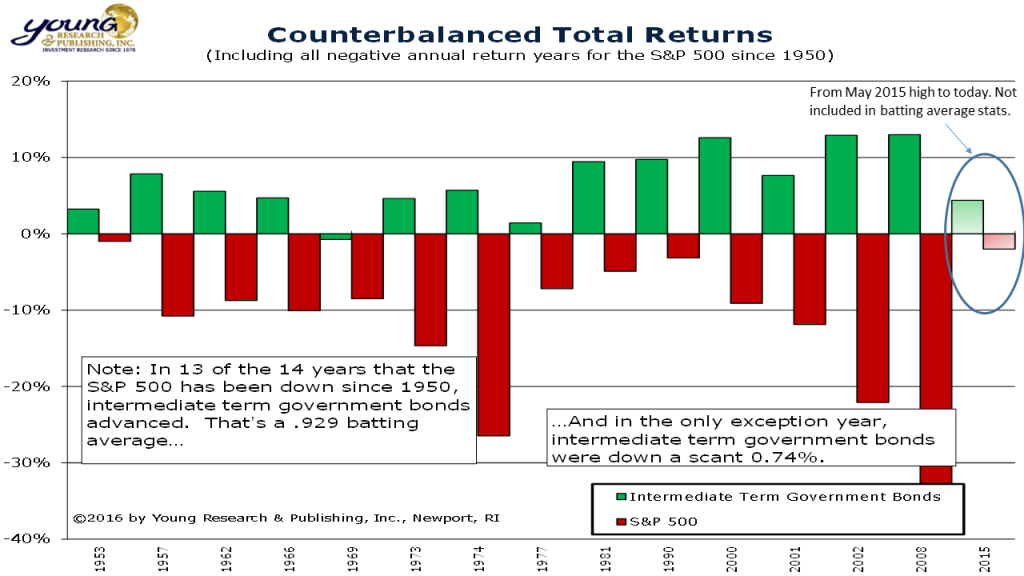

The chart below shows the performance of bonds in every calendar year the stock market has been down. In 13 of the 14 years that the S&P 500 has been down since 1950, intermediate-term government bonds advanced. That’s a .929 batting average. And in the only exception year, intermediate-term government bonds were down a scant 0.74%.

We haven’t seen a calendar down year for the stock market since 2008, but the last two bars on our chart show the performance of the S&P 500 from its May 2015 high through today. From its May 2015 high, the S&P 500 is down about 2% and as you would expect, intermediate-term government bonds advanced—4.4%.

Despite today’s painfully low yields, bonds remain a necessary component of a well-diversified portfolio and especially a well-diversified retirement portfolio.