The S&P 500 hit a cyclical bull market high on April 29 of this year. During a volatile session on Tuesday, the index dipped into official bear market territory (a drop of more than 20% from a recent high), but a stunning final hour rally of more than 4% helped the index narrowly escape the official bear market label.

Should you care if the S&P 500 enters an official bear market? Unless your entire portfolio is invested in an index fund, the S&P 500’s performance is likely to differ, sometimes widely, from the performance of your own portfolio. For example, if your portfolio includes a meaningful allocation to bonds, you are likely down much less than the index. Or if your portfolio is invested heavily in European shares, you may be down much more than the S&P 500. The Euro Stoxx 50 index is already deep in bear market territory—falling more than 35% from its recent high. But even if you invest entirely in large-capitalization U.S. stocks, the return on your portfolio may differ from the return of the S&P 500.

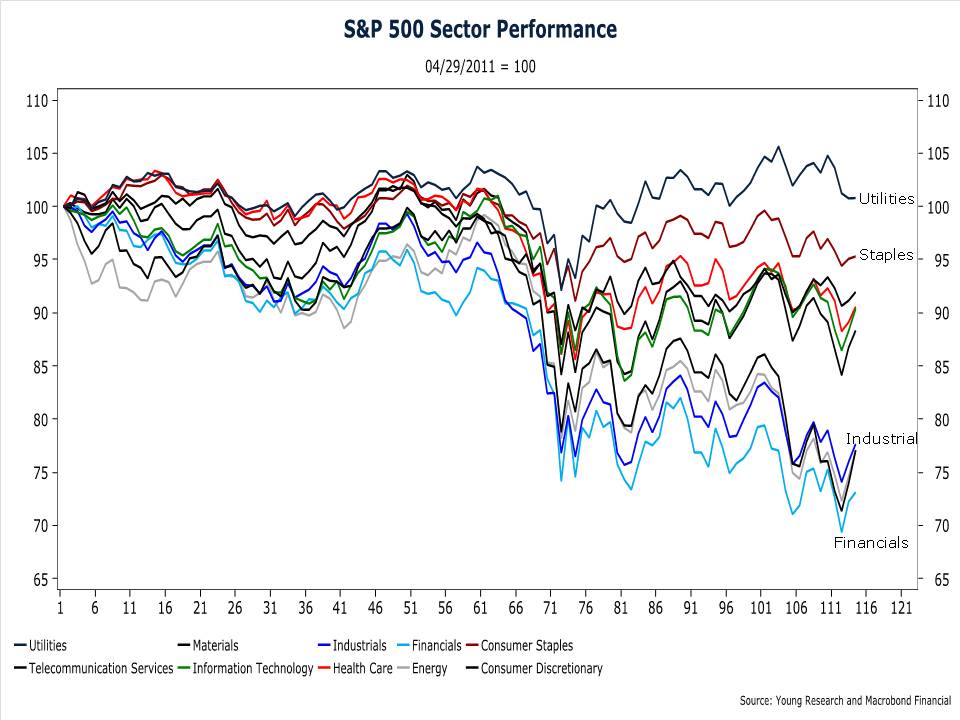

Consider the varying performance of the 10 sectors in the S&P 500. My chart tracks the return of the 10 sector indices by setting their value to 100 on April 29. To calculate the percentage return of each index, simply subtract 100 from its current value. The horizontal axis is the number of days since April 29. As you can see, the best performing sectors are the most defensive. Utilities stocks are actually up since the market peaked while consumer staples stocks have fallen less than 5%. Contrast that with the performance of financials and industrials which are deep in bear country. If you’ve invested with a defensive approach you may be down only marginally from the April high while the S&P 500 is down close to 20%. If your portfolio isn’t loaded with broad based U.S. index funds, it isn’t safe to equate your portfolio’s performance to the performance of market indices.