You being in the top 97th percentile in good looks and wealth might be good. But being in the top 97th percentile in the fees you pay your investment advisor is…not so good.

PriceMetrix, a wealth-management software firm, has come out with a report showing that a significant variation in pricing exists between investment advisors. The firm has quite a database to pull from—15,000 advisor books, 2.3 million investors, 380 million transactions, 1 million fee-based accounts, and over $850 billion in investment assets. The study examined the pricing on balanced accounts for households with between $250,000 and $500,000 in assets to eliminate any asset allocation or asset size influence.

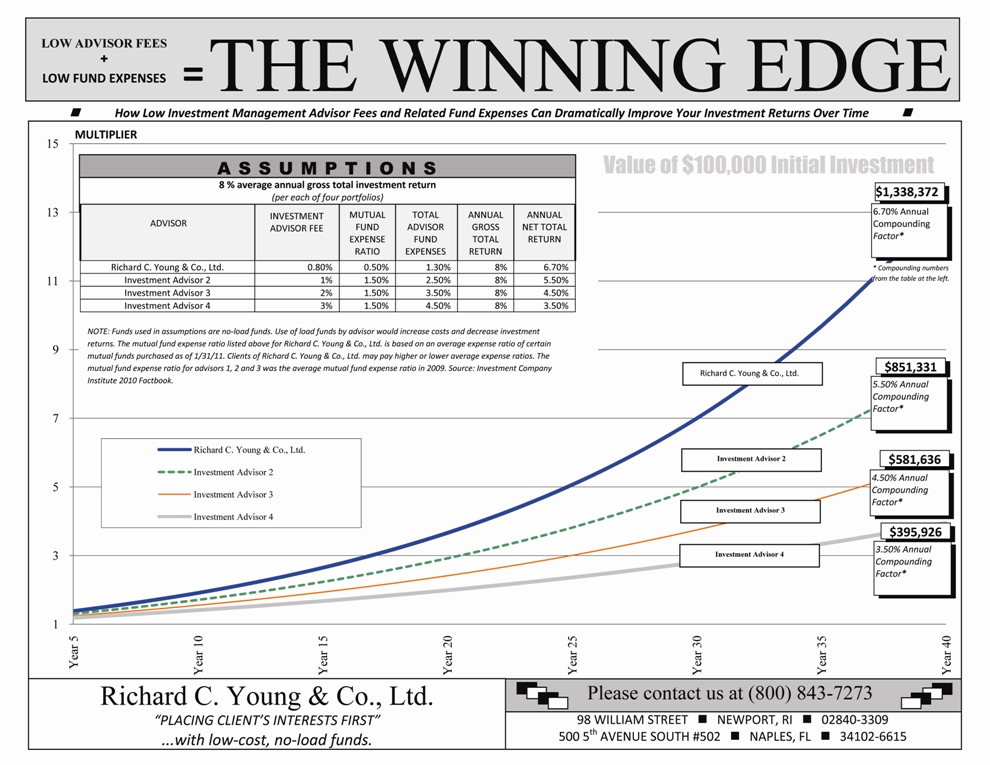

Twenty-five percent of advisors charge more than 1.75%, averaging 2.08%. Twenty-five percent charge less than 1.01%, averaging 0.81%. I like to show prospective clients this chart to illustrate the importance of keeping fees low. It’s pretty clear you don’t want to be in the 97th percentile—advisor fees of 3% or higher can cost an investor hundreds of thousands of dollars.