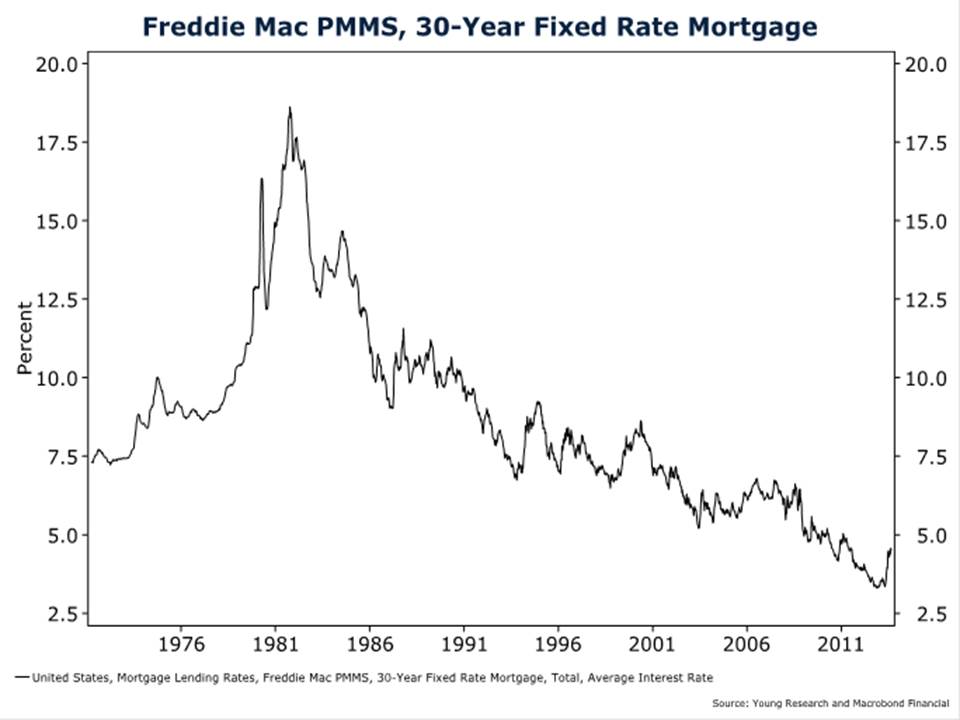

It’s not getting any easier when it comes to buying a home. Take a look at the spike in mortgage rates on my chart and its impact on buyers like Amy and Ted Wilder.

Amy and Ted Wilder lost out in the bidding for several Seattle-area homes during the past six months, even with offers well above the asking price. After May’s sudden spike in mortgage rates, the Microsoft Corp. consultants put their search on hold. “We fell in love with a house for about $400,000 and thought we could afford it, and then we discovered it was $300 more a month than what we would have paid in February when we started looking,” Amy Wilder, 42, said. “The mortgage rates just pushed it too far.”

A surge in borrowing costs to a two-year high is starting to cool demand from homebuyers as higher rates combine with surging prices to reduce affordability, according to data released this week. The biggest pinch is being felt in expensive markets such as Seattle and New York, where budgets already were stretched, leading to a more uneven national recovery.

Contracts to buy previously owned homes fell 1.3 percent last month, the biggest decline this year, the National Association of Realtors said two days ago. They slid 6.5 percent in the Northeast and 4.9 percent in the West, the data showed. The figures followed a report last week that July new-home sales plunged 13.4 percent, paced by a 16.1 percent drop in the West.

“There is a bigger monthly payment shock in the high-cost areas,” said Lawrence Yun, chief economist for the Realtors group. “Higher interest rates may pull demand out.”–Bloomberg