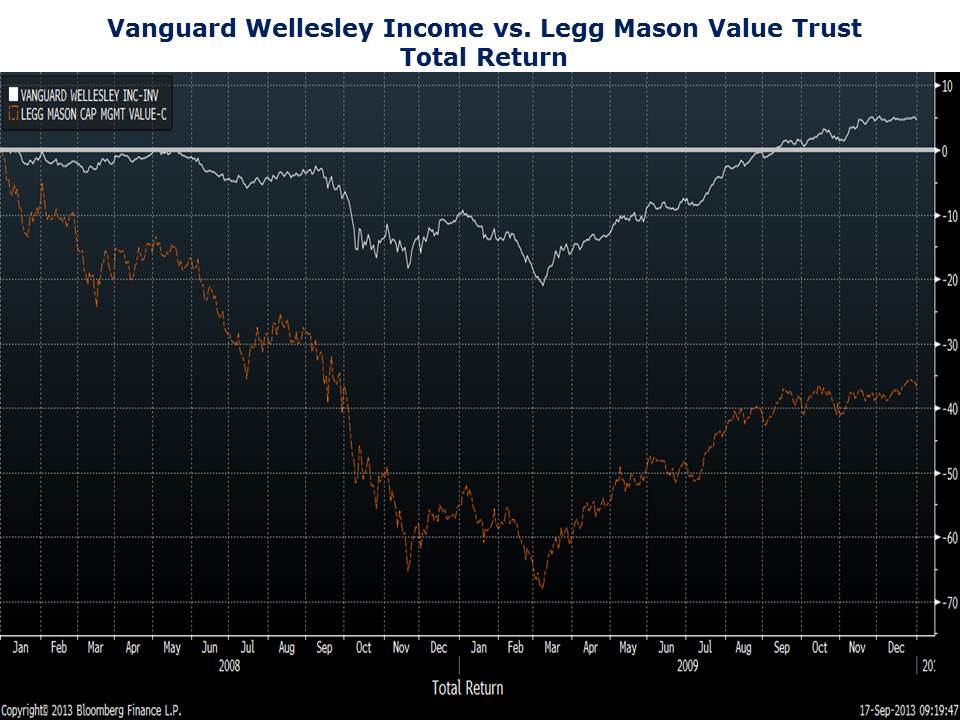

You want to keep this chart on your refrigerator because there’s been a lot of talk in the press lately about 2008. Looking back five years later is always easier than living through it. What the press fails to explain is the emotional and financial toll 2008 leveled on so many retirees. There’s a breaking point for every investor. For those (there’s more than you think) that had too much in the stock market that point was clearly met five years ago this month. Too many sold at or near the bottom and have never fully recovered. I have a feeling those that got out are now back at it again, investing in stocks hoping to make back what they lost. Investors who went into 2008 with a balanced portfolio were spared from the emotional and financial roller-coaster and lived to fight another day. Look no further than the Vanguard Wellesley fund for the cold hard truth about 2008. While the Dow dropped 34%, the S&P close to 40%, and others by more than 50%, Vanguard Wellesley was down less than 10%. That’s how you win the war.

By comparison, the Legg Mason Value Trust cratered through 2008.

Make sure you have a plan in place to deal with destructive market volatility. It doesn’t have to be your undoing. And if your investable assets are around $2 million and want to speak with me directly then email me at ejsmith@youngresearch.com to get help crafting a portfolio for your specific situation.