There have been many explanations of the apparent slowdown in the housing market over recent months. If you haven’t been following the news on housing, new home sales fell 14% last month and have stagnated since early 2013. Existing home sales also dipped in March and on a seasonally adjusted basis they are down nearly 15% since July of last year.

The Federal Reserve says it must be higher mortgage rates that have dented housing demand.

Others attribute the softness in housing to demographic factors.

And some think falling demand can be explained by harsh winter weather.

While there are likely shades of truth in all three explanations, they fail to mention the most important factor in every market. That isn’t interest rates, or demographic trends, or even weather. The most important driver of markets is the same as it has been for decades, centuries really. That driver is price.

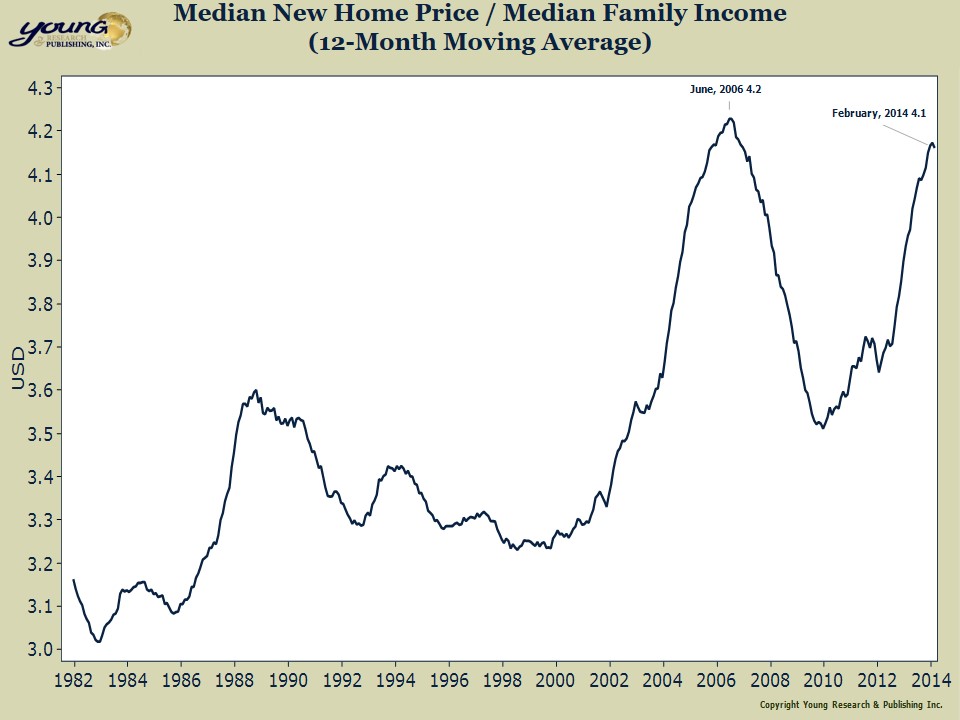

Home prices have risen sharply over the last two and a half years. Family incomes have not. The predictable result of higher prices and stagnant incomes is lower demand. Most of us learned that lesson at a young age while manning a roadside lemonade stand. It seems others never did.

Zero percent interest rates and quantitative easing may have helped re-inflate housing prices, but not in an organic or sustainable way. The Fed’s easy money policies haven’t lifted consumer incomes and while mortgage rates are low, try getting one. The trillions of dollars of excess liquidity sloshing around the financial system has driven capital into every nook and cranny of asset markets, levitating prices including those of homes.

The reality on the ground is that housing demand has waned because prices are too high. Median new home prices hit an all-time high in March. Relative to family incomes, prices are back at bubble-era levels.

Existing home prices have bubbled up recently as well, but they haven’t yet surpassed their bubble era peak. Existing home prices relative to family incomes are in what you might call overvalued territory.

The bottom line: Keep it simple. Pay attention to prices. When homes become more expensive people buy fewer of them.