There is an odd dynamic in the bond market that Wall Street can’t seem to figure out. Long-term Treasury yields are falling despite an economy that is showing signs of life. It is an apparent conundrum to many.

Some analysts are attributing the move down in yields to the recognition by investors that there is a new lower speed limit for the U.S. economy. Others claim that yields are falling because pensions, endowments, and insurance companies are now flush. These investors are believed to be cashing in their equity chips and investing the proceeds in bonds. Still others believe that low foreign bond yields are driving investors into U.S. Treasuries.

So which is it? What is the true reason long bond yields have fallen this year when most investors expected them to rise?

If you were hoping for the definitive explanation on falling bond yields I am sorry to disappoint you. Markets are messy and respond to myriad factors. I am sure there are elements of truth in all of the explanations I cited above. But I would like to advance an alternative explanation of falling Treasury yields. An explanation that is surprisingly getting little attention.

It is no secret that the Federal Reserve has been buying billions worth of bonds every month for the better part of two years. Some might argue the Fed’s bond buying is the primary reason the stock market has performed so well (I’m in this camp), the primary reason volatility has vanished on Wall Street, and the reason social media stocks and bio-techs are trading at bubble valuations.

But it would seem that the Fed has been buying bonds for so long that many investors have taken the Fed’s influence for granted. It is as if these investors have forgotten they are still wearing the rose colored shades that Dr. Bernanke handed out before his big performance. This could be a costly mistake.

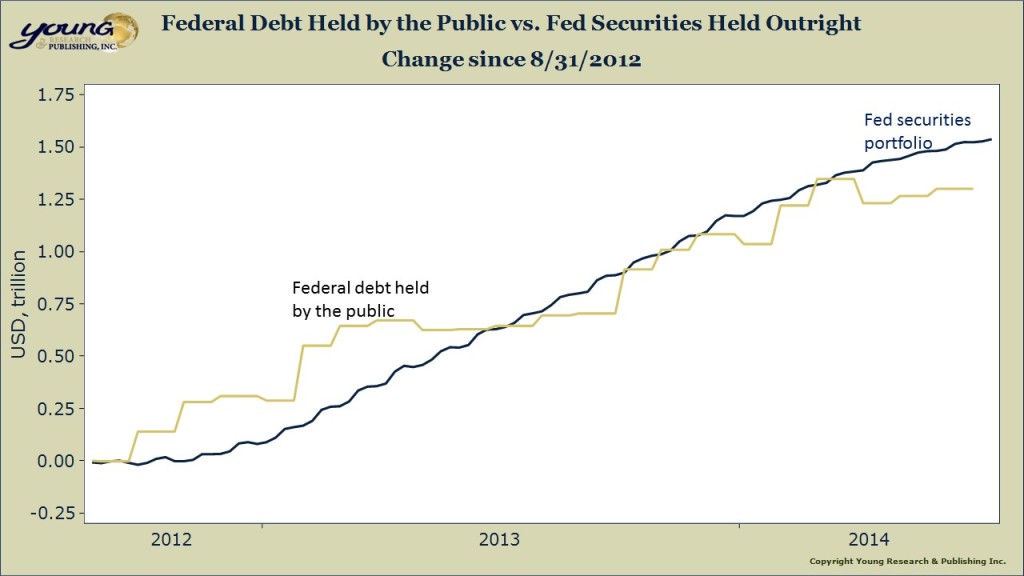

To get a picture of just how important the Fed is to the Treasury market, check out my chart. You are looking at the cumulative change in Federal Debt held by the public and the Fed’s securities portfolio. The start date is August of 2012, just prior to the beginning of QE3.

Shocking is it not? The Fed has effectively purchased every dollar of new debt issued by the Federal Government (yes, half the purchases were in MBS, but the effect is about the same). So why might the bond market be pushing yields lower in the face of an improving economy? The only person who can answer that question is Janet Yellen because a true market for long-term Treasuries no longer exists. The Fed has become the long-term Treasury market.