By The7Dew @ Shutterstock.com

The 2010s were kind to U.S. stock market investors. There wasn’t a single bear market (down 20% from peak to trough) in the U.S. and stocks compounded at double-digit rates.

The challenge for investors, as opposed to speculators, is that the gains were not driven entirely by improving fundamentals.

The Big Driver of Stock Returns in the 2010s

A convincing case can be made that the biggest driver of stock prices over the last decade was distortive monetary policy from the world’s biggest central banks. When the price of money is held at zero (negative in some countries) for nearly a decade into an economic expansion and the balance sheets of the big three central banks balloon almost 4-fold (from 2008), distortion becomes unavoidable.

Distortion in Markets is Pervasive

The distortion has manifested itself across all asset markets and in corporate behavior where cheap debt has been used to finance stock buybacks. Over the last decade, stock buybacks of S&P 500 companies totaled well over $5 trillion.

Investors who have captured the full gain in U.S. stocks over the last ten years have 1.) an extremely high-risk tolerance 2.) a poorly diversified portfolio and 3.) a serious affinity for speculation.

Why speculation?

Based on our internal estimates, about 40% of the return on stocks in the 2010s was driven by investors’ willingness to pay an ever-increasing price for the same stream of earnings. And don’t forget, that doesn’t count the debt-financed buybacks and lower interest costs from a decade of easy money. Both factors show up in higher earnings per share growth (normally a fundamental driver of stock prices) but have little to do with underlying company fundamentals.

Realized Returns Out of Step with Fundamentals

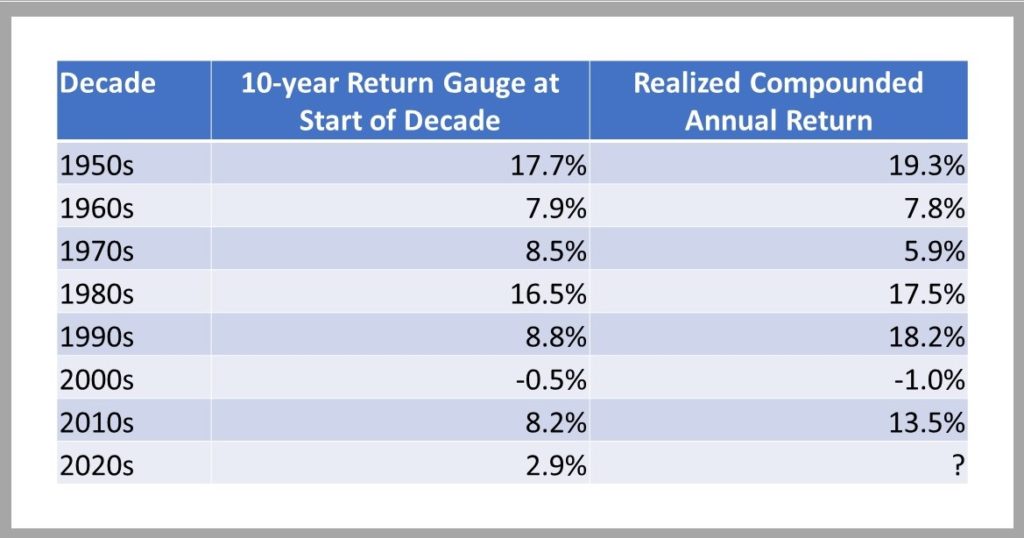

The table below compares the compounded annual return of the S&P 500 each decade with an internal measure we use to gauge long-term total returns. Our gauge does a decent job of getting within a percentage point or two of the realized return for each decade with two notable exceptions, the 1990s, and the 2010s.

In both periods, the returns realized for the decade were significantly higher than our gauge signaled at the start of the decade. In the 1990s, it was the dotcom bubble that drove the market far above fundamental value. In the 2010s, it was a prolonged period of ultra-loose money that drove returns much higher than would be expected based on company fundamentals.

In the decade after the dotcom bust, the giveback was wicked. The S&P 500 lost money over a 10-year period with two nasty bear markets that cut the index in half on both occasions.

What will the 2020s Bring for Stocks?

After a decade of distortion in the 2010s that drove returns far above levels indicated by underlying fundamentals, will the 2020s bring a similarly dismal outcome for investors?

While it is possible this time is different, if you are retired or on the verge of retirement, the only prudent thing to do is to prepare for lower returns and the prospect of another major downturn within the next decade.