Your Survival Guy wants you to understand that you own bonds so you can invest in stocks. As the late, great, Ben Graham explained about portfolio allocation, investors need to fall within a 70-30 mix of stocks and bonds, or vice versa.

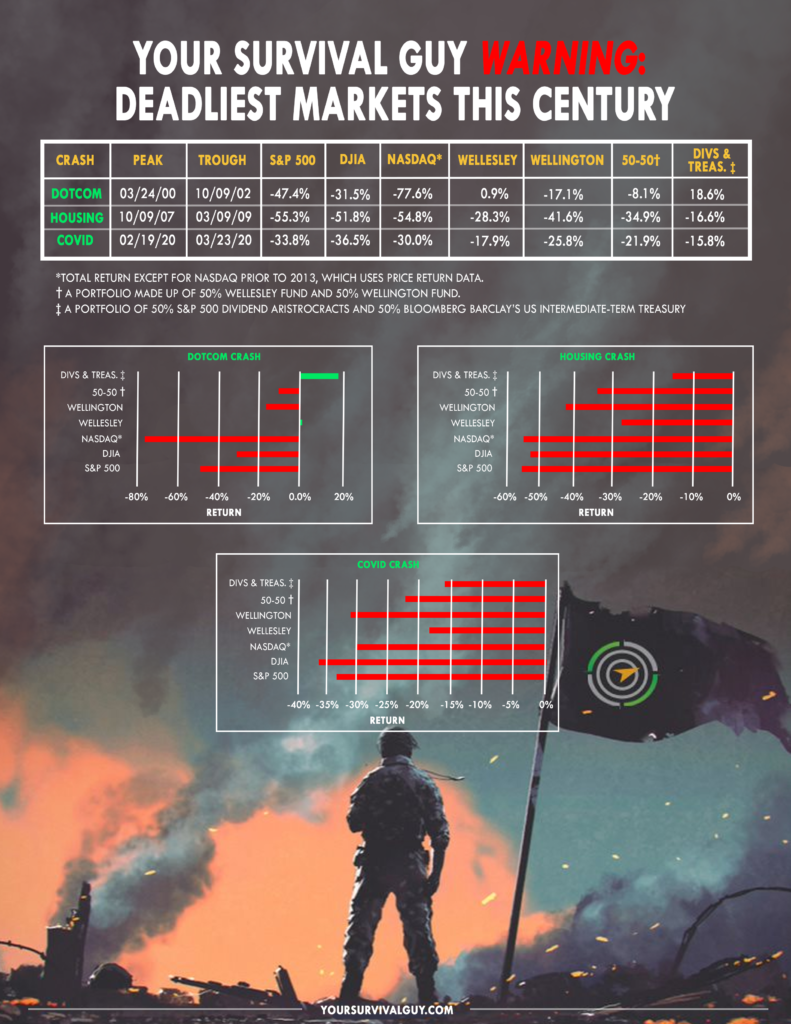

In other words, even the most aggressive stock jocks need to have some bonds as an anchor to windward. You might be shocked at how much of a cushion having just 30% in bonds can provide for a portfolio in a market decline. But check out Your Survival Guy’s Deadliest Markets This Century for proof.

And for the most conservative, or wealthy among us, who don’t want to fool around with stocks because they’re already as rich as Croesus, there’s the 70% in bonds. There’s nothing wrong with becoming rich slowly. (Invest Like a Rich Man, Not a Poor Man).

Think about your bonds as an asset, much like a home. When interest rates go up, real estate prices go down. If a home has a $400,000 listing price and interest rates are at 4%, a buyer does the mental math to see if it’s better to rent or buy. When interest rates are 11%, that house will probably sell for a lot less (if the owners are serious about selling).

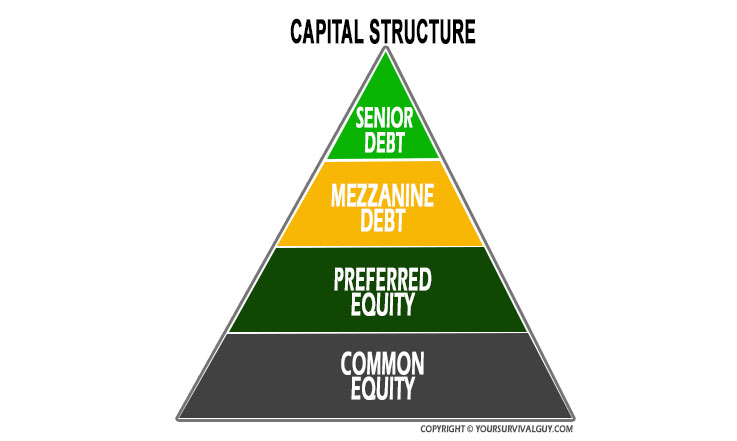

When you consider your exalted standing as a bond holder (with first rights to any assets in the event of default) you can see in Your Survival Guy’s Capital Structure Pyramid that you’re well above the common shareholders.

In this market you need to know the 5 W’s of what you own. Because when you look closely at the mutual funds and exchange traded funds (ETFs) in your portfolio, you might find that their top ten holdings all look very similar. You thought you owned hundreds of stocks, but it’s the same top ten holdings driving the bus in most of these market cap weighted funds—the 800 pound gorillas.

Action Line: Walking amongst the wreckage in a scorched earth economy requires Your Survival Guy-like instincts. You need to be focused. I can help. If you’re serious. Click here to sign up for my free monthly Survive & Thrive newsletter, and each month I’ll push you to stay focused and achieve your goals. But only if you’re serious.

Originally posted on Your Survival Guy.