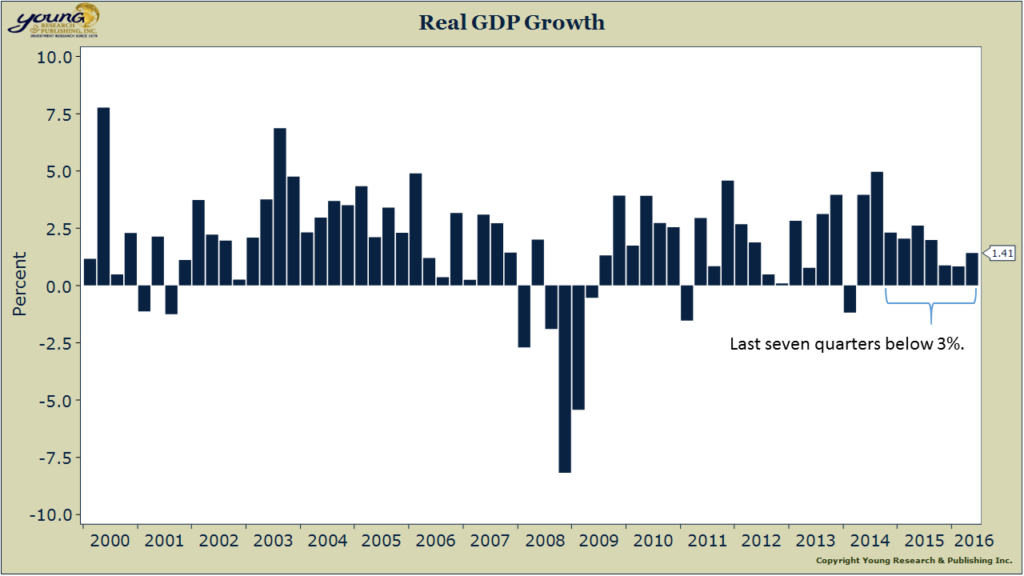

You’ll get your first view of U.S. third-quarter economic growth this week. The U.S. economy advanced at a pathetic 1.1% rate through the first half of the year. The Atlanta Fed cut its estimate to 2.4% from 2.8%. In any event, looking at an eighth straight quarter of growth below 3% is not very exciting.

I like to think about GDP at the basic level, as though it’s a paycheck. Imagine two workers, A and B over their 40-year careers. If A can increase his salary by 4%, then after 40-years he will have increased it five times vs worker B’s doubling it after growing at only 2%. Time, and a higher growth rate, are the keys to success.

Now, compare this to today’s stock market. Stock market prices continue to rise despite slow global growth forecasts for GDP, and despite the worst post-recession recovery since the Great Depression. Worldwide easy money policies have created a charade in markets. As the media trips over themselves with how “great” the third quarter GDP and the stock market look, remember one thing: It’s not real.