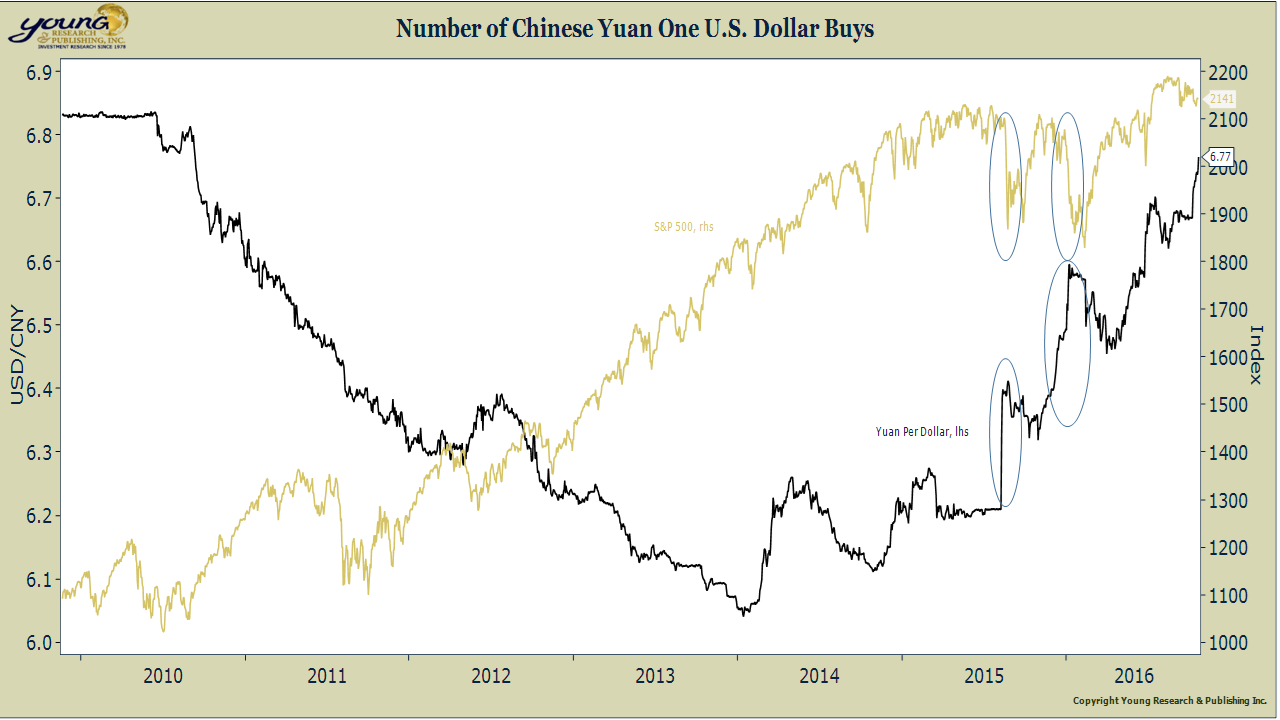

The Chinese yuan has fallen to a new six-year low as outflows surge. The central bank has either been overwhelmed by currency flooding out of the country, or it is allowing the yuan to drift lower to help the economy. The Chinese economy is the world’s second largest, and China has long been a source of deflationary pressure in the world. A depreciating yuan points toward more deflationary pressure for the rest of the world. As you can see in our chart below, a depreciating yuan hasn’t worked out so well for the U.S. stock market. Bloomberg has more on the weakening yen.

China’s outbound yuan payments surged to a record in September, indicating greater pressures on a currency that has weakened to a six-year low in both onshore and overseas markets.

A net $44.7 billion worth of yuan payments left the nation last month, according to data posted on the State Administration of Foreign Exchange’s website Friday. That’s the most since the government started releasing the figures in 2010, and compares with August’s outflow of $27.7 billion. Goldman Sachs Group Inc. has warned such large cross-border moves can’t be explained by market-driven factors and need to be taken into account when measuring currency outflows.

The yuan has come under increased pressure of late, with some analysts speculating that the central bank has reduced support after the currency entered the International Monetary Fund’s Special Drawings Rights on Oct. 1. Renewed strength in the dollar has added to the stress, with the offshore yuan trading near a record low and the onshore currency declining in all but one session this month.