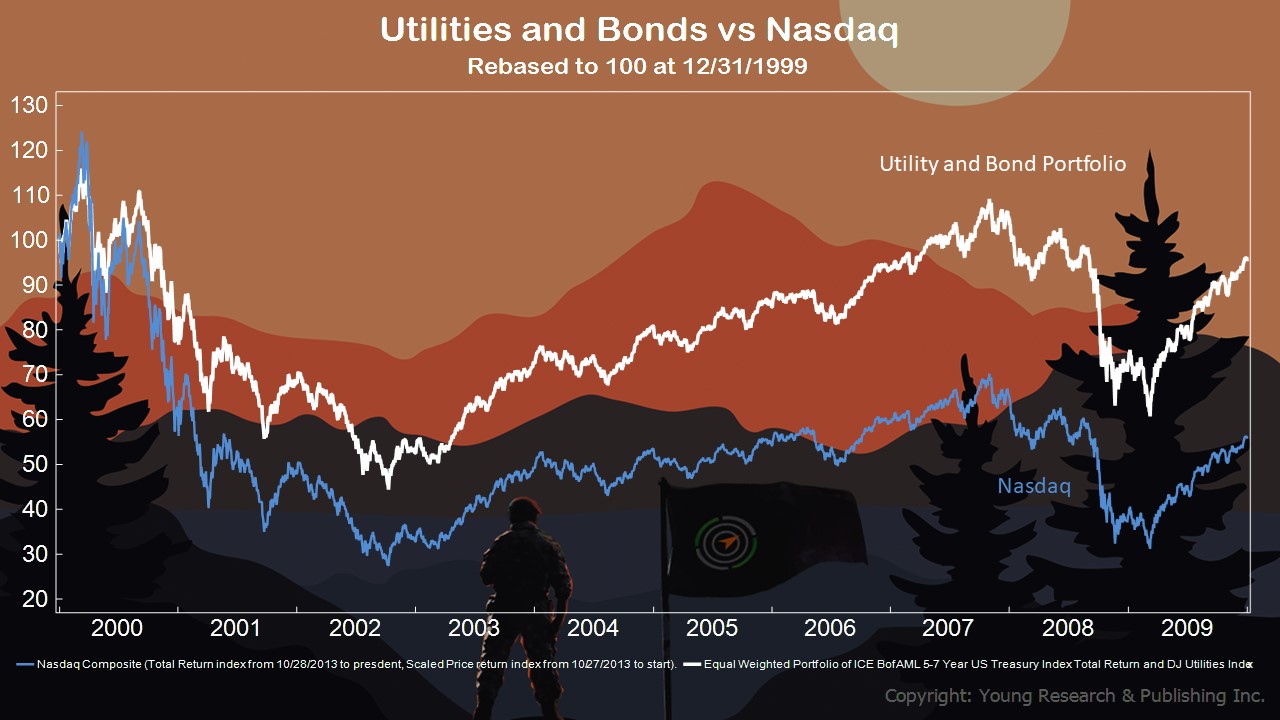

Let’s imagine it’s 1999. You’re about to retire. You had a good career. And like anyone else invested in stocks, you’ve had a good run. Then, some time goes by, you’re on a European riverboat cruise, and boom, the tech bust hits. That was the exact moment many investors realized their risk tolerance was, in fact, intolerance. Like a food allergy. But it was too late.

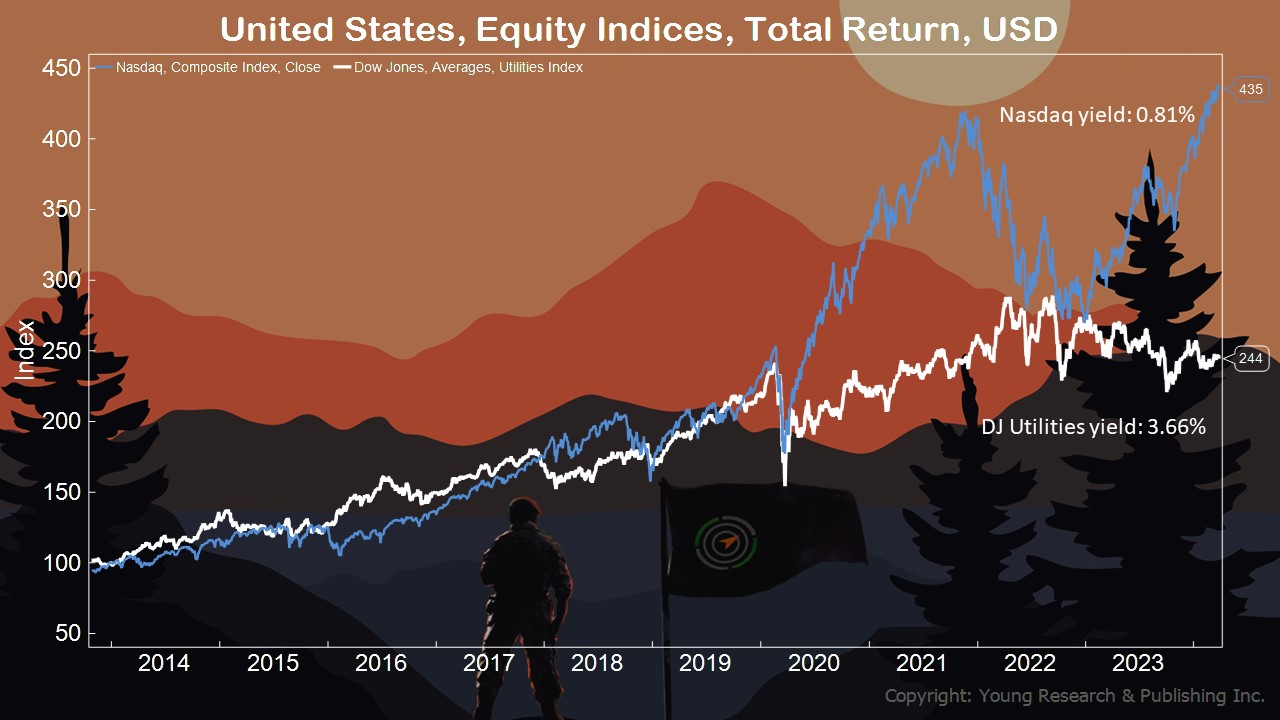

In my conversations with some investors—not you, of course—expectations today are still through the roof. That’s what a bull market will do. And as you know, the common refrain is “I want preservation of principal and growth.” Hey, I get it. It’s that time of year to pray. But I’m Your Survival Guy, not you know who.

Here we are at the end of the first quarter of 2024. The world is a mess, bridges are falling, and yet CNBC is asking, “What do you think about AI and crypto?”

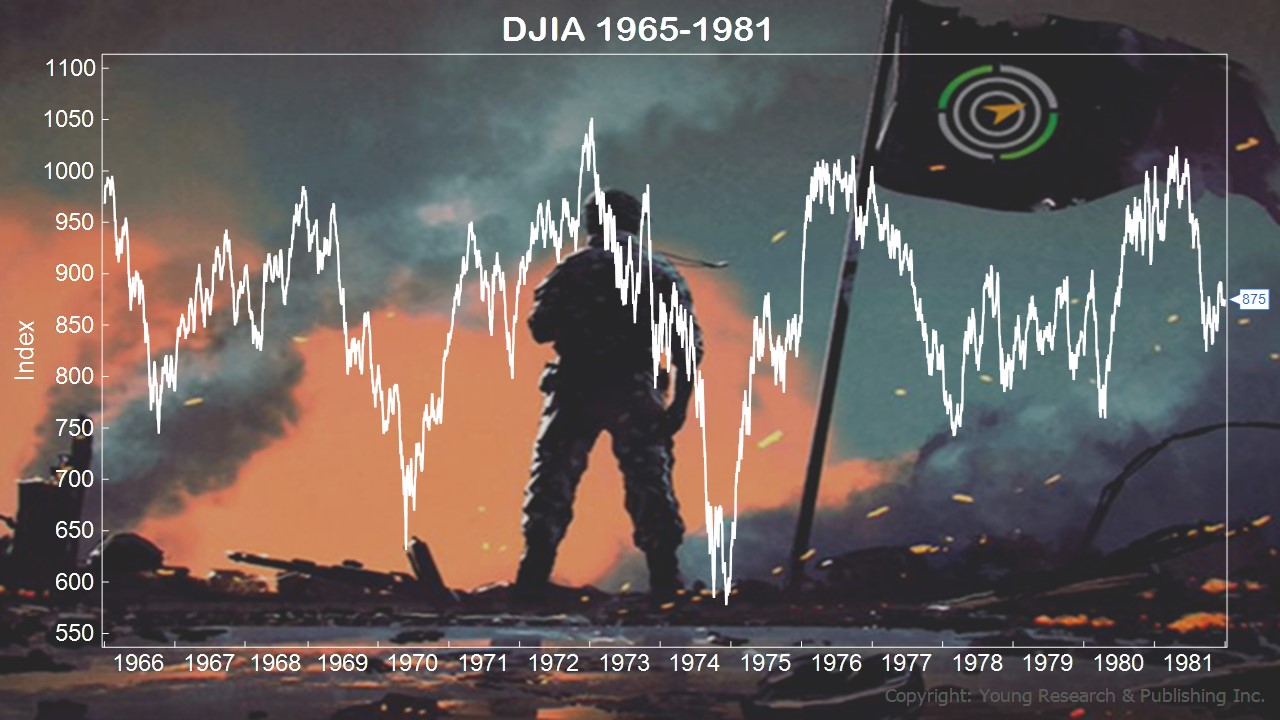

Listen, investors have become fat, dumb, and stupid. And may I add, I think there’s going to be a lot of heartache, but it won’t be anyone’s fault. Right? As always, investors tend to blame their losses on something else. Any Prudent Man should tell you this might be your grandfather’s market.

Let’s take a trip, dear reader, back to 1999. Imagine if, instead of tech stocks (I’ll be kind and use Nasdaq even though many individual components blew up, never to return again), you had a mix of Utilities and Treasuries?

Action Line: Want to invest in AI and crypto? Look to the source: energy/utilities. I want you to get some dividend religion. I want you to get paid. Can I get an Amen? Let’s talk.

Originally posted on Your Survival Guy.