A major publication is doing somewhat of an about-face on the virtues of balanced investing. As I mentioned, there have been a couple of foul balls lately in the form of articles with themes along the lines of “balanced investing is dead.” “Please stop,” I said to myself. “Is there a greater disservice to the long-term investor?”

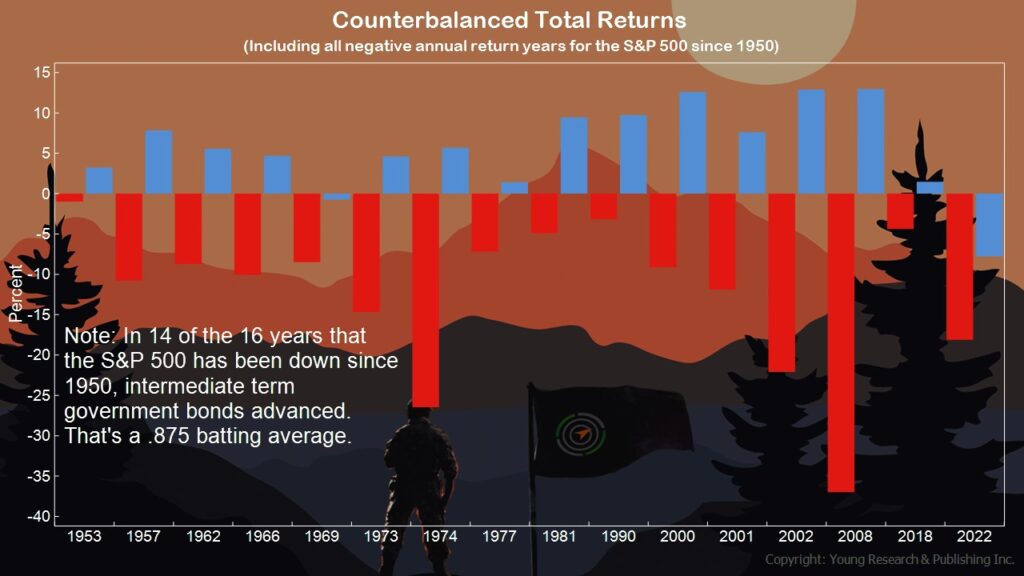

A wise man once wrote, in his strategy report, Richard C. Young’s Intelligence Report, about how savvy investors should invest within a framework of 70-30 of stocks and bonds, or vice versa. In my regular conversations with him, Dick Young, my father-in-law, he reminds me about that golden nugget of advice. “Survival Guy,” he says, “Allocation is the straw that stirs the drink.”

Whether you have a mix of Wellesley and Wellington or some other derivative of a balanced strategy, including Treasury Money Markets and a consumer stock fund, or individual securities and bonds, you’re a balanced investor.

What can be difficult is remaining balanced when prices are down. “How’s our money, honey?” can be a tough question to answer. Thankfully, you have Your Survival Guy to help explain.

Action Line: To all my balanced readers, sleep well(esley), be well(ington), and to all a good night. Let’s talk before the New Year, so you’re ready to go in 2024.

Originally posted on Your Survival Guy.