Your success as an investor has much to do with your temperament. It’s more art than science. That’s not coming from me. That’s from years of reading my father-in-law’s newsletter, Richard C. Young’s Intelligence Report. He’s pulled me aside many a time to remind me: “Survival Guy, listen to me, investing is more about art than science. Yes, you’ve got to have the chops, but it’s the art that makes the music.”

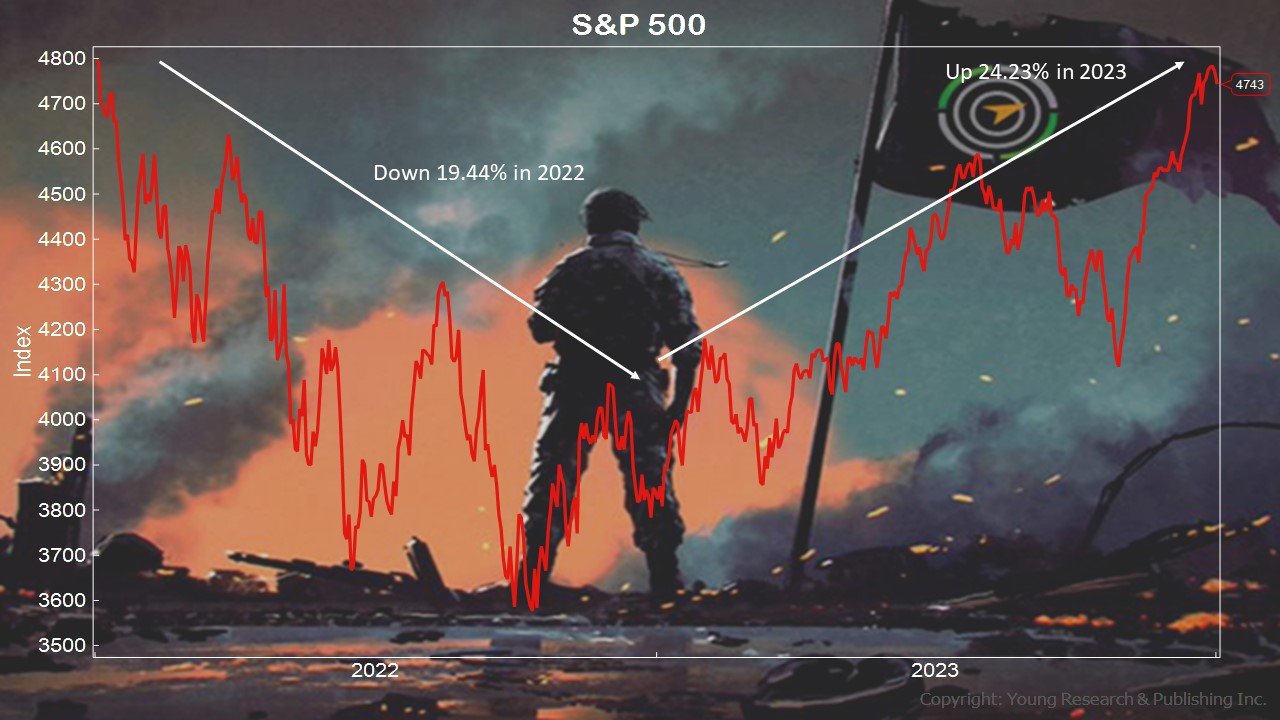

And here we are at the national anthem stage of 2024. And yes, it’s been a wild couple of years for the S&P 500. Sort of reminds me of the Daytona 500, with investors circling back around the track after some close calls. That doesn’t sound like fun, but hey, I’m Your Survival Guy. I don’t like my investments spinning their wheels. A slow and steady pace is just fine by me.

Which reminds me of the onslaught of advertisements investors face about past performance. Remember, past performance is the hook that snags the average investor. I hope you’re not average. The late Charlie Munger reminded investors once of when he asked a bait and tackle shop owner if a certain lure caught fish. “I don’t sell to fish,” the owner said.

The late great Jack Bogle said, “Don’t just do something, stand there.” A perfect tenor for today’s volatility or fast money. I know, it’s hard not to look. And unfortunately, we will need to deal with the mess.

There may come a time in your retirement life when you won’t want to deal with the violent swings on your own. Where you’ll want someone like Your Survival Guy to help guide you. Don’t look at it as defeat. You simply realize you have too much to lose. Understanding when that is, is more art than science.

Action Line: When that time comes, I’m here.

Originally posted on Your Survival Guy.