By AnnaTamila @ Shutterstock.com

A balanced portfolio is far from dead. It keeps you in the game, so you don’t have to time the market. Yesterday was the biggest one-day percentage gain for stocks since the depths of Covid and the biggest one-day plunge in 2 and 10-year treasury bond yields in over a decade (remember, when rates fall, bond prices increase).

You don’t want to be in the prediction business. Markets are in the business of making winners and losers daily. I want you to focus on investing to earn dividends and interest. Let the prices do what they do—I don’t need to be in the rah, rah, rah business. This is about creating wealth, not short-term wins (and losses).

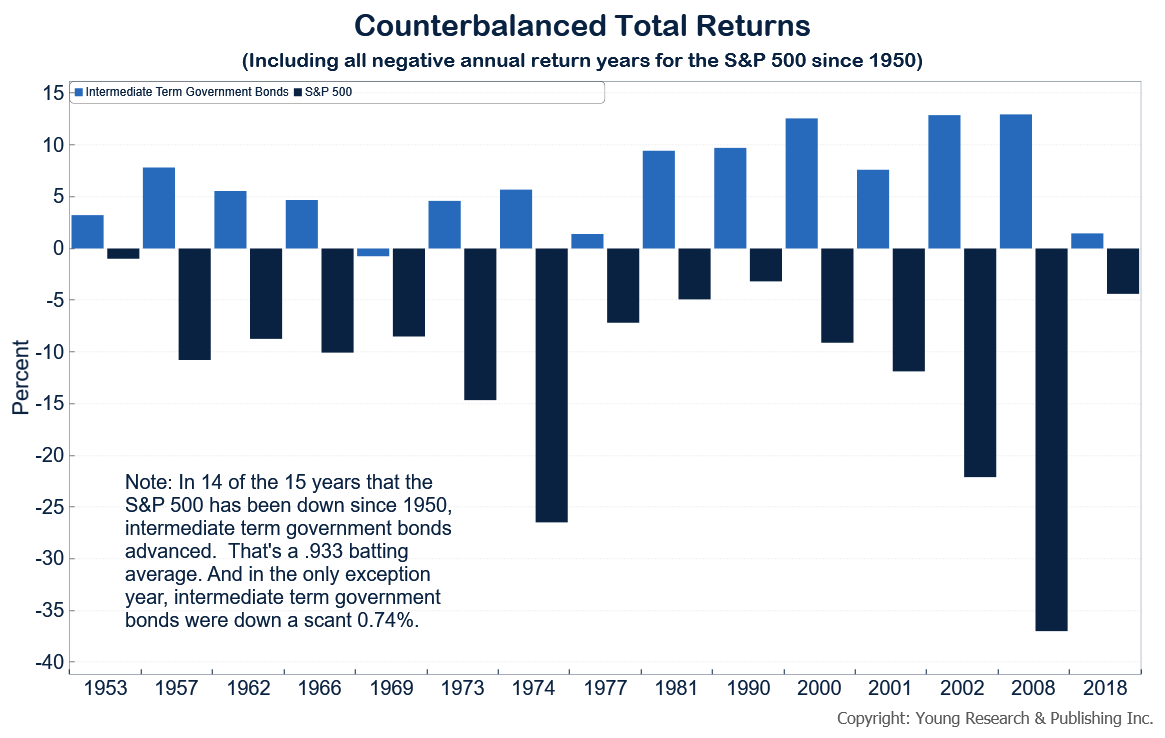

Look at the performance of treasuries in years when the S&P 500 had negative returns. Since 1950, in every year but one since 1950, when the S&P 500 lost value, treasuries gained.

Americans are reacting to what looks like a GOP majority in the House, and the prospect that the administration’s inflationary spending will be curbed. As comparison numbers from last year of Bidenflation roll over, index numbers might not look so bad, but the reality is that prices are still much higher than two years ago. Don’t look for them to get back to Trump-era levels any time soon.

Action Line: You don’t need to go all in on any old risky investment you’re told is the next big thing. Look at what’s happening in crypto to see how that goes. Instead, find balance. If you need help, let’s talk.

P.S. CRYPTO: A Generational Reality Check that Markets Are Cruel

It never ceases to amaze me how investors find new ways to lose money. They tell you about their wins and can’t believe it when they lose. If they’re rolling in cash, where are they when it comes to helping pay for dinner? Do they get alligator arms? Did they brag about how well they’re doing while picking up the next round for everyone at the bar? Crypto is this generation’s reality check that markets are cruel. Maybe schools should teach that instead of the other nonsense being taught. This week, cryptocurrency owners using FTX to hold their coins are facing disaster, as the firm attempts to return $8 billion worth of assets being demanded in withdrawals. It’s like a modern-day bank run. Vicky De Huang reports in The Wall Street Journal:

FTX was hit by a run of withdrawal requests this week and the company is scrambling to raise money to cover a shortfall of up to $8 billion, The Wall Street Journal previously reported. The exchange lent billions of dollars to fund risky bets at its affiliated trading firm, Alameda Research, using money that customers had deposited at FTX for trading purposes.

Crypto expanded steadily into the mainstream in recent years and crypto lenders and brokers pitched themselves as avenues for regular people to make money. Some newbies embraced crypto trading, using platforms like FTX to try to time the market. Others thought they were taking a safer route by using FTX and other crypto firms to park their money as if it were a bank deposit—but earning a much greater yield than any regulated bank would pay. Many in both groups are now in desperate situations.

Trading is still operational at both FTX and the American arm, according to traders. The website for the American arm said as of Thursday evening that “trading may be halted on FTX US in a few days.”

A spokesman for FTX declined to comment. In a Thursday tweet, FTX founder Sam Bankman-Fried said he is sorry and that his No. 1 priority is to do right by users.

“Every penny of that—and of the existing collateral—will go straight to users, unless or until we’ve done right by them,” Mr. Bankman-Fried said.

In 2022, big crypto losses are a familiar tale for many people. Lenders like Celsius Network and Voyager Digital filed for bankruptcy this year and many of their customers are losing hope that they will get their money back. Even one so-called algorithmic stablecoin, meant to maintain a set value, crashed this year, leaving traders with little recourse.

A spokesman for Voyager said U.S. dollar withdrawals are active but that crypto withdrawals are still on hold until the restructuring process is complete. A spokeswoman for Celsius didn’t respond to a request for comment.

Crypto attracted hordes of new traders during the pandemic, many of whom had never given much thought to bitcoin until they were stuck at home. The price of bitcoin and other digital currencies soared in 2020 and 2021 along with the stock market, leaving some newbies with the impression that crypto could only go up.

But crypto in many ways is little more than a casino. Unlike the regulated, traditional financial system, it lacks the government rules and legal protections built into banks and brokerages. Notably, their deposits aren’t guaranteed by the federal government.

Originally posted on Your Survival Guy.