President Donald J. Trump, joined by Vice President Mike Pence and Treasury Secretary Steven Mnuchin, addresses reporters Monday, June 24, 2019, in the Oval Office of the White House prior to signing an Executive Order to place further sanctions on Iran. (Official White House Photo by D. Myles Cullen)

Since the financial crisis, mortgage companies Fannie Mae and Freddie Mac have been languishing on the federal government’s balance sheet. The two federally backed mortgage securitization companies were taken into government conservatorship in 2008. Now, Federal Housing Finance Agency director Mark Calabria has been tasked with the almost impossible task of reprivatizing them. I know Mark from his time at the Cato Institute, and I can tell you that he is passionate about this fight.

If anyone can do it, it’s Mark, but it won’t be easy. Congress has been less than helpful to the Trump administration in its attempts to offload the mortgage behemoths the government adopted during the financial crisis. But with a new plan (you can read it below), and Mark taking point on this issue, there is hope for success.

The Wall Street Journal’s editorial board writes of Calabria’s fight:

Enter the Trump Administration, which last week proposed to gradually shrink the GSEs and return them to private hands. Treasury wants Congress to authorize the FHFA to charter competing “guarantors” with an explicit government guarantee that private investors (as well as Fannie and Freddie) would have to pay for to offset the taxpayer risk.

Putting a price on the taxpayer guarantee has some merit, but Congress rejected this idea last session and is cowed by the housing lobby. That leaves Mr. Calabria, who has substantial discretion as the new FHFA chief. He could start by reducing GSE support for cash-out refinancing, investor loans, vacation home loans and higher principal-balance loans. The American Enterprise Institute’s Ed Pinto estimates that leaving these businesses over time could shrink the GSE footprint by 45%.

The Administration also suggests levelling the regulatory field by subjecting Fannie and Freddie to comparable capital and underwriting standards that private lenders must meet. The Federal Reserve requires banks to hold more than twice as much capital for comparable loans than Mr. Watt proposed for Fannie and Freddie. Another idea is to form a nonaggression pact with the FHA to prevent a competitive erosion of lending standards.

The Trump Treasury wants to let the GSEs build capital for an eventual public release, and perhaps an IPO, which could mean raising as much as $180 billion. The risk is that, once they have more capital, Congress will release them without restraints. But there’s also a risk that the next Democratic administration will simply nationalize them and exert even more government control over housing finance. Mr. Calabria’s most urgent task is to make Fan and Fred less dangerous by shrinking them.

Read more here.

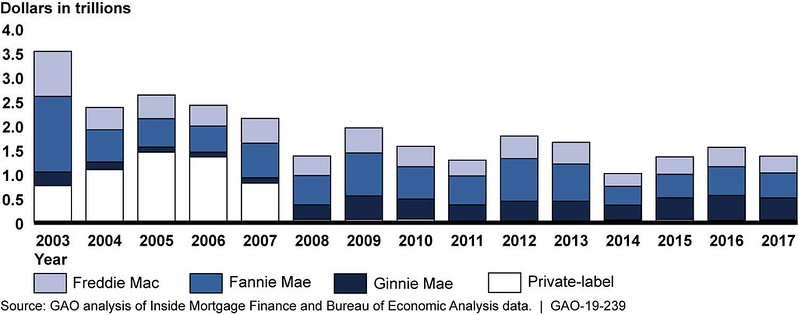

Single-Family Mortgage-Backed Security Issuance, Federal and Private, 2003–2017, Adjusted for Inflation

This image is excerpted from a U.S. GAO report: www.gao.gov/products/GAO-19-239

HOUSING FINANCE: Prolonged Conservatorships of Fannie Mae and Freddie Mac Prompt Need for Reform

Note: Fannie Mae and Freddie Mac purchase mortgages and issue and guarantee mortgage-backed securities (MBS). Ginnie Mae guarantees MBS backed by federally-insured mortgages. Private-label MBS do not have a government guarantee.

[pdf-embedder url=”https://www.yoursurvivalguy.com/wp-content/uploads/2019/09/Treasury-Housing-Finance-Reform-Plan.pdf”]

Originally posted on Your Survival Guy.