In The Wall Street Journal, Josh Zumbrun examines the evidence that investors should design a retirement portfolio that lasts more than 30 years. He writes:

Demographers and actuaries make the following distinction between life expectancy and longevity: Life expectancy refers to the average number of years someone will live from a given age, whereas longevity refers to how long he or she might live if everything goes well, typically expressed as the probability of living beyond a certain age such as 85, 90 or even 100.

A growing body of evidence shows that many people are ignorant of their so-called longevity risk—the probability of living a very long time—and the complications that presents.

“A lot of people are thinking about life expectancy, but the extent to which people are asking questions about longevity is much lower,” said Abigail Hurwitz, a professor at the Hebrew University of Jerusalem who studies pensions and behavioral finance.

Financial advisers say that both Social Security and personal savings are necessary for a comfortable retirement, and that many people outlive the latter. Among those ages 65-69, 18% receive over 90% of their income from Social Security. By age 80, that rises to 33%, according to a 2017 study.

Drs. Hurwitz and Mitchell note that retirement calculators provide information about average life expectancy, but not longevity. They have found that about five times as many Census Bureau publications relate to life expectancy as longevity. Thus, people who have planned appropriately for their life expectancy might miss how likely they are to live longer.

People can look up their longevity risk with an online Longevity Illustrator maintained by the American Academy of Actuaries and Society of Actuaries, based off the latest mortality data from the Social Security Administration.

They might be surprised, especially by the probability that one member of a couple could live a very long time, said James Poterba, a Massachusetts Institute of Technology economics professor who has long studied retirement-savings patterns.

Mr. Poterba provides the following example: “If Joe and Jane are 65, have just retired, don’t smoke, and are both in excellent health, there is a 46% chance that at least one of them will still be alive in 30 years.” (That is, one would be 95 years old.)

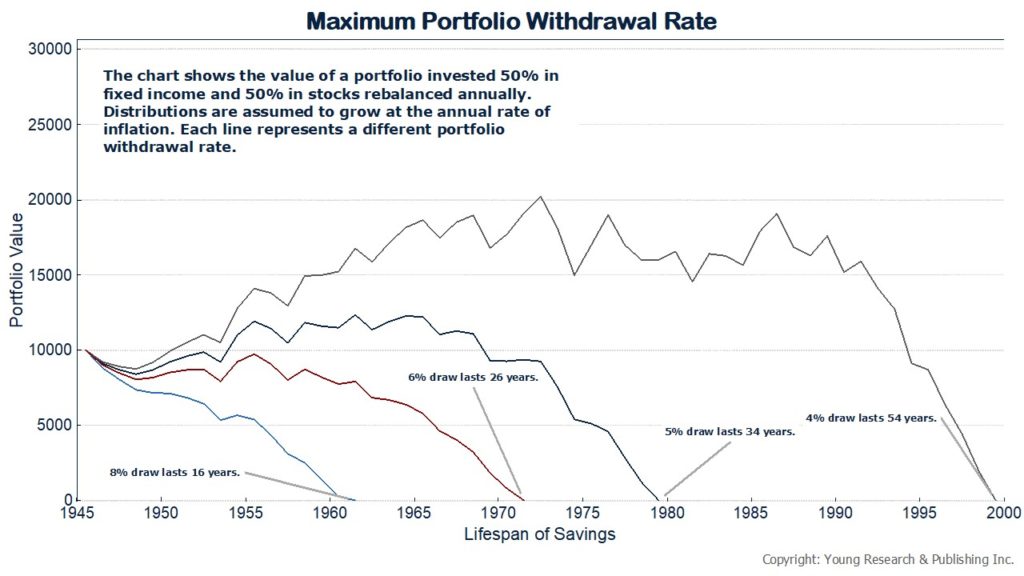

The draw rate on a portfolio will also help determine its longevity.