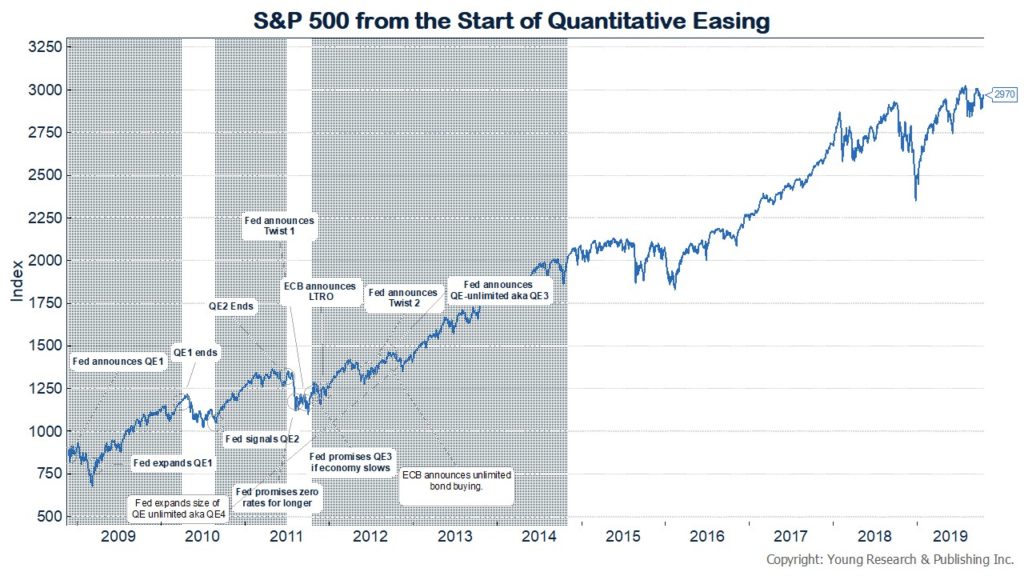

UPDATE: It’s been two years now since the last issue of Richard C. Young’s Intelligence Report, and the more things change, the more they stay the same. The Fed just announced it will begin buying $60 billion a month in T-bills. And the cycle continues.

“I’m going to miss hearing from Dick Young every month,” said one long-time reader of Intelligence Report, “I’ve been reading his letter for 25 years. He was the best hands-down. He always wrote to me the way he saw things.” That’s a common refrain I’ve been hearing over the last couple of weeks. In an industry littered with opinions, you could always depend on the integrity of Dick Young and Intelligence Report.

Since 1998, when I first started working with Dick and Matt Young, prospective clients have been saying: They trust Mr. Young, they’ve followed his advice for years, and now that they’re older they can’t afford to make a mistake.

That’s a powerful emotion when it comes to investing: You can’t afford to make a mistake.

It’s an emotional time when you stop earning money and have more than you’ve ever had in your life.

But keeping too much of your hard earned money “safe” means you and your money are in retirement mode. You can’t afford that either. It’s a brutal task managing money today, thanks to the low interest rate environment that has inflated stock prices. Or, I should say, it’s a brutal task to realize that future returns are likely to be well below expectations.

You need to have an “expectation reality check,” because things are moving fast. What do you invest in when high stock prices make you queasy and yet stocks are used as currency? Take a look at yesterday’s news, for example: United Technologies Corp. in talks to buy Rockwell Collings, Inc.

Today, the big fish are gobbling up the smaller one’s and who’s complaining? Not Rockwell’s shareholders. The stock closed at $130, up 155% from a year ago.

The environment we’re dealing with today has been manufactured. Not by workers in the mid-west busy building the things America needs, but by the so-called geniuses at the Fed. They’ve engineered low interest rates that have helped boost real estate valuations for some, especially private equity investors, but has also ignited the stock market.

Low interest rates have been the invisible tax (actually quite visible on monthly statements). And adding insult to injury, the Fed buying up bonds for its own balance sheet has left income investors searching for yield in far away places rather than the historical safe harbor of full-faith Treasuries.

Look at the charts and see the connection between the Fed’s reckless policies and what it has done to stocks. It’s truly criminal the way the savers of this country have been kicked to the side of the road in favor of Wall Street.

That’s today’s reality. If you can’t afford to make a mistake (can anyone really?), then you need to take a hard look at how you’re invested. I’d be happy to talk with you. The lessons we all have learned in Intelligence Report are never going away. You can email me anytime at ejsmith@youngresearch.com. I look forward to hearing from you.

Originally published August 30, 2017.