When I was a junior in high school I spent a week as a crewmember on a schooner. One of my duties was taking a shift each night on watch.

On calm nights it was pretty peaceful. But less so when the wind was up and the white caps lashed against the hull. On nights likes these, you had a more purposeful walk to the bow to check the anchor line.

Our captain made the night watch a priority no matter the weather. I learned a lot from his seriousness and expertise.

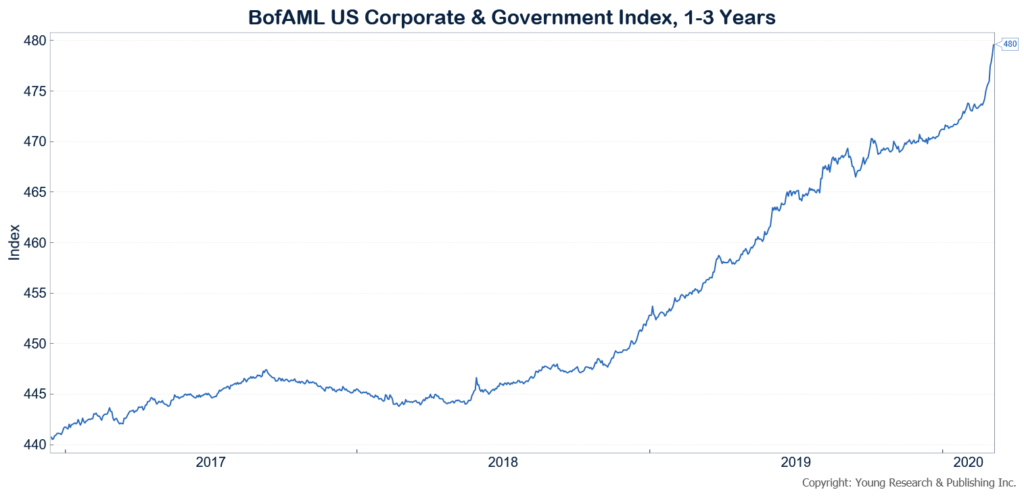

If you were to listen to the so-called experts, you would have sold your bonds a long, long time ago. Don’t listen to them. Your bonds are your anchor to windward.

Now, buying the right kind of bonds requires a certain amount of expertise.

That I can help you with. You need to make sure your two main risks—credit and interest rates—are reduced to a palatable level.

Treasuries and agencies are the best credits, and short-term maturities help if interest rates go up.

Own them outright, as opposed to in a mutual fund or ETF, and you have a recipe for some safety in your portfolio no matter the weather.

Read my entire series, Coronavirus Infects Stock Market here.

Originally posted on Your Survival Guy.