Originally posted January 23, 2018.

Value investing is dead, or so one might have assumed based on the relative performance of value portfolios during the current bull market. Value investors have been fighting a losing battle over the last decade.

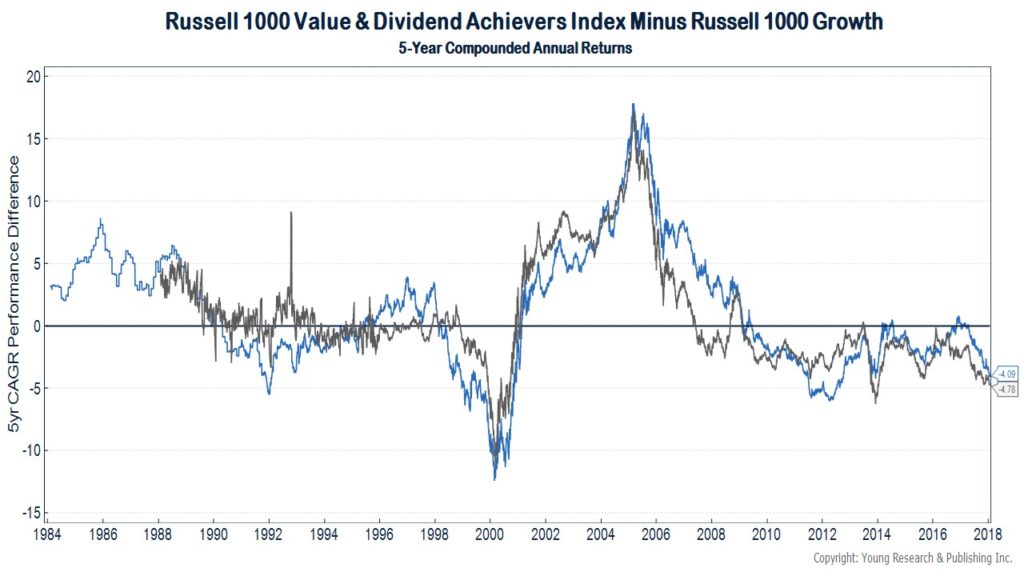

The chart below compares the difference in the performance of value stocks, as measured by the Russell 1000 Value Index and the Dividend Achievers Index to growth stocks as measured by the Russell 1000 Growth index. Each line on the chart represents the difference in the 5-year compounded annual growth rate of the value index and the growth index.

As you will note, value stocks started lagging growth stocks in 2009 and have essentially under-performed in every five-year rolling period since.

What Is the Source of Value’s Under-Performance?

Is the proliferation of quantitative investing strategies that are more easily applied to a value approach driving down returns to value investing? Or could investors be measuring value wrong? Are profits, cash flows, and dividends no longer the proper determinants of value? Should investors instead be looking at revenues, subscribers, and the potential for disruption?

Maybe it is all macro-driven. Nearly a decade of zero percent interest rates and the trillions that have been pumped into the global financial system by central banks has undoubtedly created a more favorable backdrop for growth stocks.

It isn’t unique in the history of markets for value stocks to underperform over certain periods, but the extent of this dry-spell has some investors (even some value adherents) questioning value’s continued usefulness as an investment strategy.

Should you abandon value in your own portfolio and instead jump on the FAANG-stock bandwagon?

Value Stocks Win over the Long-Run

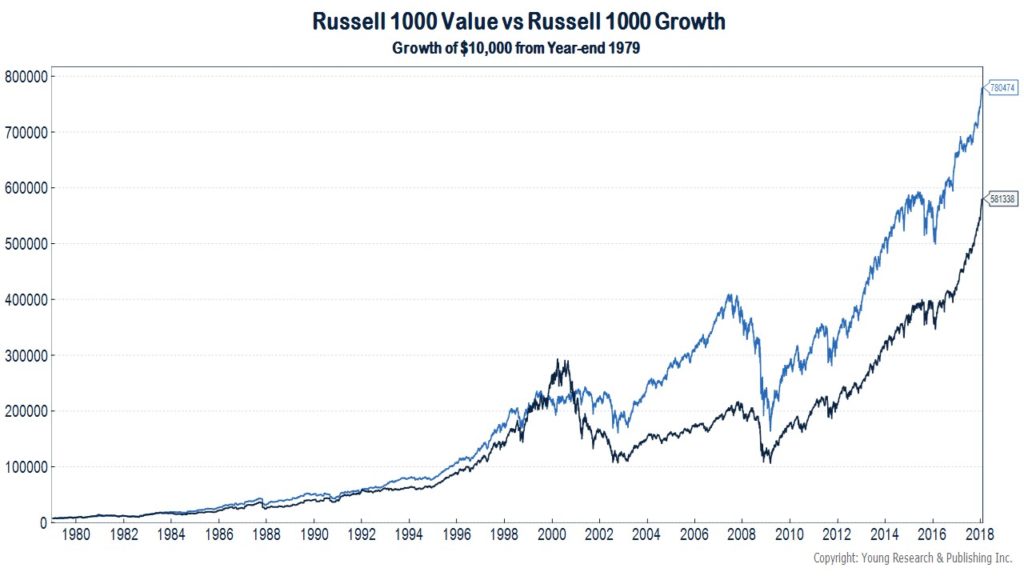

Before you make any rash decisions, consider that over the long-run, value has beaten growth by a wide margin. If you invested $10,000 at year-end 1979 in Russell 1000 Value index, you would have over $780,474 today. That same $10,000 invested in the Russell 1000 Growth index at year-end 1979 would only be worth $581,338 today. Yes, the past may not be prologue.

Why Value Stocks Outperform

But it is important to recognize why value has performed so well over the long-run. Value stocks have warts. They are hard for many investors to own. There is career risk involved with value investing, especially when growth is in favor. Who doesn’t want to own an Amazon or a Netflix when almost every American is familiar with both services and their stock prices are going up? It doesn’t matter to most investors that neither generates significant profits today, “they are the future” is the siren song.

Contrast that with an out of favor retailer trading at a deeply discounted price that is getting disrupted by Amazon. That is a hard stock to own and one that becomes even harder to own if its price falls. If you are managing other people’s money and the investment doesn’t go your way, “I told you so,” is the common refrain followed by “you’re fired.” That hasn’t changed and probably never will.

As value strategies become easier for investors to pursue (think ETFs), if they are to maintain a long-term performance edge, they should become more difficult to own. Has it been difficult to stick with a value approach when growth has performed so well over the last decade? Indeed it has. Has it been frustrating to watch companies that generate a fraction of the cash flow as the value shares in your portfolio increase 5X while your positions languish? Undoubtedly, but recognize that a value strategy’s long-run advantage is born in the frustration and difficulty of sticking with the strategy.