More than ten years into a bull market it’s easy to forget that your investment portfolio (assuming it has been crafted properly) was designed for a full investment cycle.

How do you invest for a full-cycle investment cycle? When you invest for the full-cycle, you not only focus on how your portfolio will do when risk sentiment is at a peak, but you also consider how your portfolio will hold up when risk sentiment plunges.

There may not be a better reminder of the power of full-cycle investing than the performance of Consumer Staples stocks over the last three decades.

The Power of Full Market Cycle Investing

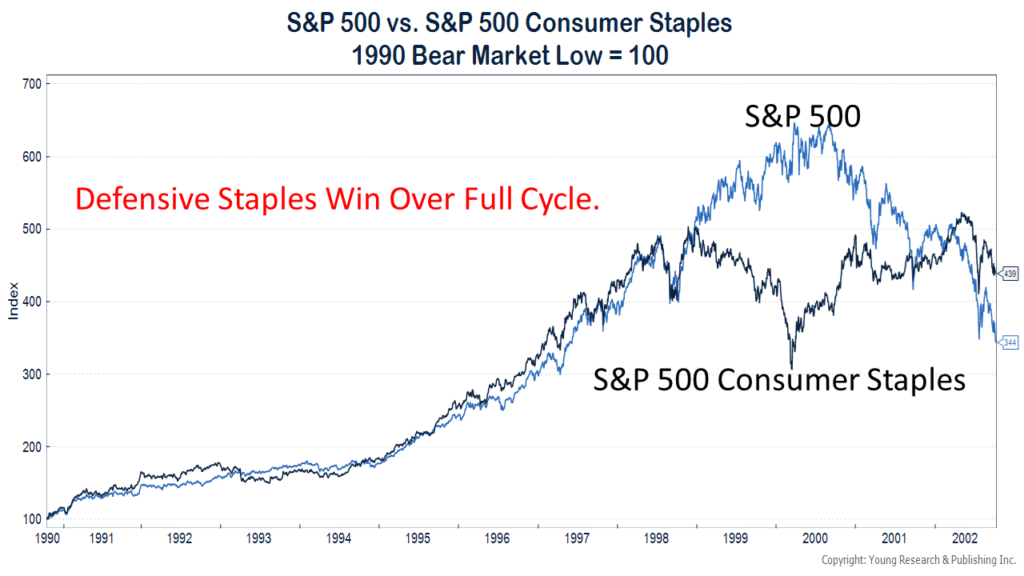

The first chart shows the performance of the S&P 500 Consumer Staples versus the S&P 500 starting at the bear market low in October of 1990.

Staples kept pace with the S&P 500 for most of the bull market, but then started to lag badly in 1999 and 2000 when “new economy” stocks stole the spotlight. At their lowest relative performance point, Staples stocks had lagged the S&P 500 by almost 50 percentage points.

Consumer Staples Stocks Win Over the Full Cycle

What happened as the cycle ended? Consumer Staples stocks pulled ahead of the S&P 500, providing investors with a higher full-cycle return.

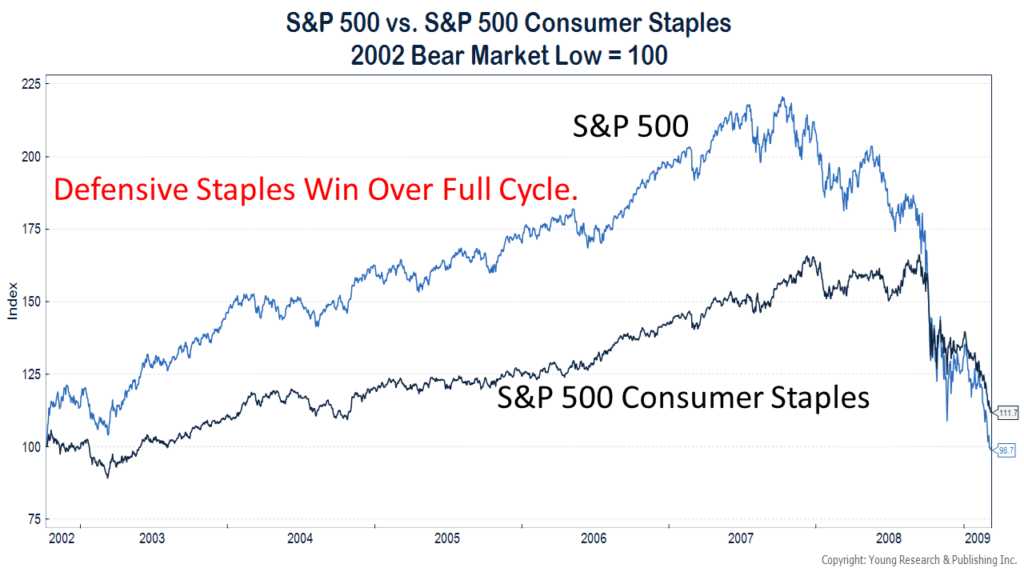

Staples stocks carved out a similar path in the 2002-2009 cycle. Consumer shares trailed the S&P 500 badly for almost the entire cycle. In fact, at the bull market peak in 2007, the S&P 500 was up a compounded 17.1% compared to a 9.4% gain for Consumer Staples index—a yawning divide of almost eight percentage points.

But by the time the bear market ended, staples stocks were once again ahead. This is despite the fact that staples shares lagged the broader index for 72 of 77 month cycle.

That’s no joke. Read that again if you brushed by it. For over 90% of the time during the 2002-2009 cycle, an investor in consumer shares would have likely been questioning his investment decisions or his investment manager’s decisions. Yet, in the end, he came out ahead and did so with a smoother ride.

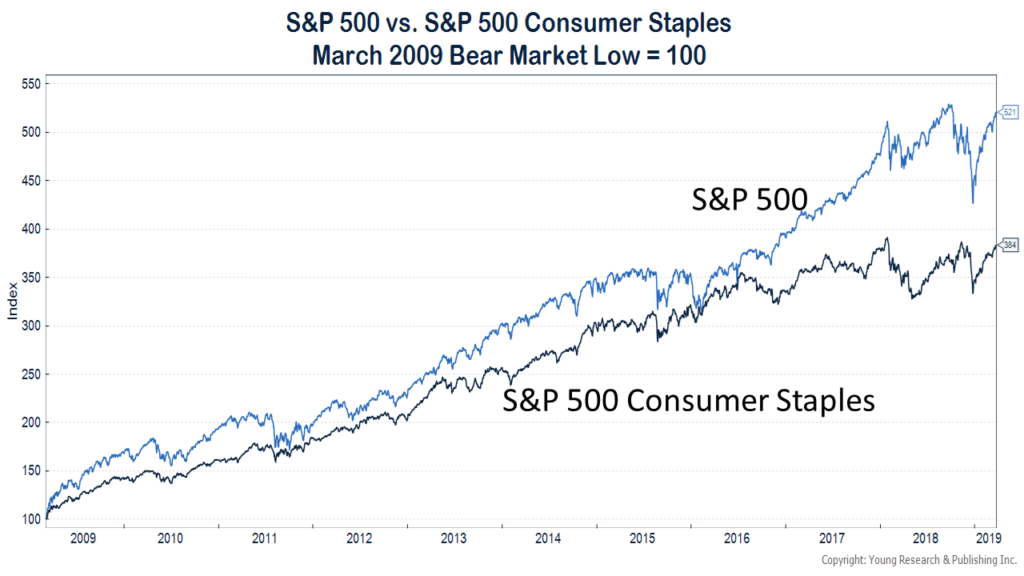

That brings us to the current cycle. This cycle is now over ten years old after being saved not once or twice by the plunge protection team at the Federal Reserve, but now what may turn out to be a third time.

There’s no doubt this cycle has dragged for the defensive investor. Ten years is a long cycle and it hasn’t ended yet. But despite all efforts to the contrary, this cycle too will end and while there is no guarantee consumer shares will come out ahead, the historical record suggests exactly that.

Cycles are part of the investing landscape. There are stock market cycles, value/growth cycles, domestic/international cycles, and credit cycles to name just a few. The savvy investor crafts and evaluates his portfolio after considering both sides of the cycle. We strongly advise you to do the same.

Patience is your greatest investment ally.