Stocks have been wild lately. They swing up; they swing down. Listen to the boys and girls on CNBC and you hear, “You bet this market’s got some legs—it should continue up.” Then the next morning Spain has trouble selling bonds, and stocks fall 100 points at the open. You could have had a better night watching Modern Family.

For my money, it’s the increase in dividends that makes a stock go up. You buy a stock, it pays a dividend, and then next year it increases that dividend. What’s not to like?

If a company increases its dividends for a loooong time, then it becomes one of the dividend elite—like Procter & Gamble. P&G announced an increase in its dividend last week. It has increased its annual dividend for 55 consecutive years.

“We increased our quarterly dividend by 9%, making this the 121st consecutive year that P&G has paid a dividend and the 55th consecutive year that the dividend has increased,” wrote CEO Robert A. McDonald in his 2011 letter to shareholders. “Over the past 55 years, P&G’s dividend has increased at an annual compound average rate of approximately 9.5%.”

P&G’s dividend per share is $2.248. The stock sells for $66.57, giving it a dividend yield of 3.38%. If history is any guide, it might increase its dividend by 9% for the next 55 years. Compounding anything at 9% for 55 years gives you 114 times more than what you started with.

Let’s say you buy a share of P&G for $66.57 and the compounded growth rate of the dividend is 9% for 55 years. The dividend on your share in 2067 would be $256.27. If the stock still yields 3.38%, your share will be worth $7,581.95. That’s one way you can justify buying their razors.

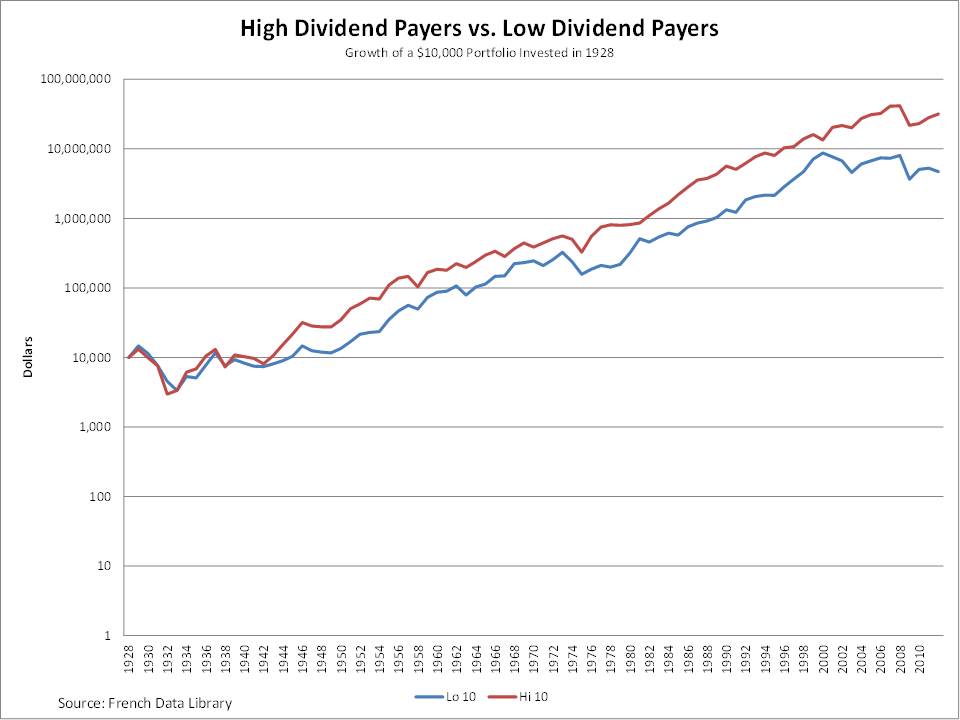

For more on investing for dividends, check out Income Investors: Be Not Afraid. The chart below is from the post and compares the difference in performance of the highest yielding 10% of stocks and the lowest yielding 10% of stocks.