Imagine only 10 years ago, before most Americans had heard of “hydro-fracking” or “horizontal drilling.” Imagine what a war in Iraq (the eighth largest oil producer) and skirmishes on the border of Russia (the third largest oil producer) would have meant to the price of oil? Prices would have skyrocketed. But today, in the face of instability in some of the world’s most vital oil producing regions, the price of oil is headed down.

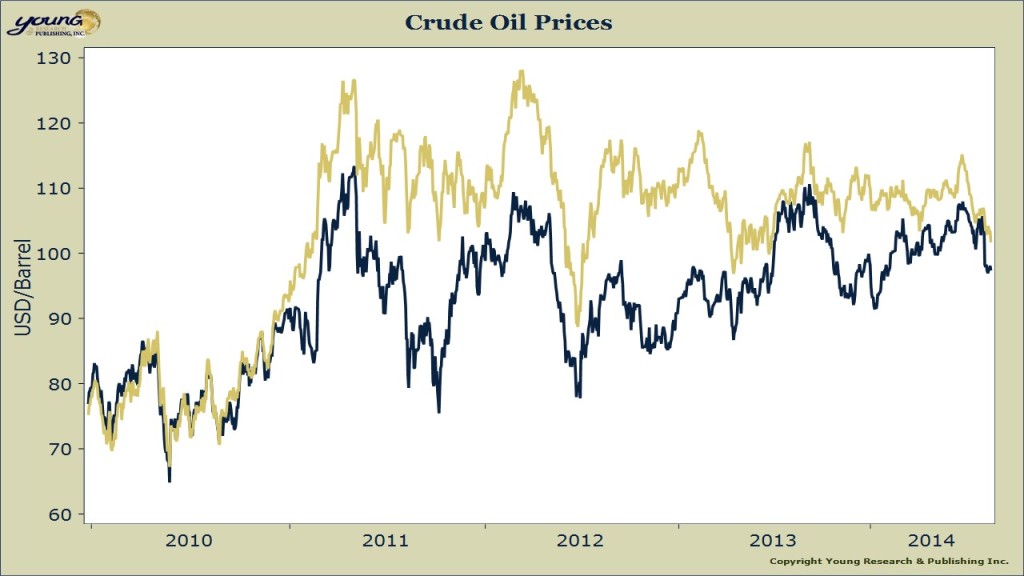

As you can see in the chart below, on July 31 the price of WTI crude dropped below $100 a barrel for the first time since May, and is now at levels not seen since late February. Brent crude is not far behind, closing at $101.68 yesterday. It appears that American airstrikes in Iraq have calmed any remaining fears in the energy markets that the radical Islamic State would threaten supplies from Iraqi oil fields. But what’s most amazing is that in the face of these threats to global supplies, prices peaked at only $115.19 for Brent and $107.95 for WTI.

The flood of crude coming from unconventional oil plays in the U.S. and Canada have offset the geopolitical threats to global oil supplies. Recently America exported its first shipment of crude in decades (though technically it was considered “condensate” and not crude oil) to South Korea. The revolution in American energy production is changing the paradigm of energy security and will have knock-on effects on the prices of petroleum products all the way down the production chain. More reliable oil prices will lead to more profitable business for manufacturers and lower prices for consumers. It’s a brand new day.