You’re asking me what I think of bitcoin and cryptocurrencies. I’m telling you, I love the idea of blockchain. But what about value? That’s more a function of what someone’s willing to pay. Not me, of course, but it’s somewhat irrelevant.

How big can cryptocurrencies get? I don’t know. Big, I guess. But I don’t need to be the first one at the party. I certainly won’t be the last, or the last one to leave. Let this play out. Remember the Gold Rush? A lot of money was made investing in the rush itself and not just the yellow metal. I like the idea of utilizing the benefits of the new. In other words, I have no problem seeing “other people’s money” take the risk.

Imagine for a second all the areas in your life where keeping track of records with blockchain or open ledger, might be useful (or not). Medical records, business contracts, mortgages, trusts, wills, estate plans, charitable giving, investment holdings, black market, vaccine passports, government control, currency replacement. ”Privacy” may not be up to you and me.

Will Bitcoin be the superhighway for blockchain, or will Ethereum? Mark Cuban believes in Ethereum. Below he explains his thoughts to Andy Kessler in the WSJ:

He’s right. I noted, “I’ve seen some are using blockchain for mortgages. I assume they or others will do titles too. So what is that end game?” “Smart contracts on blockchains, particularly Ethereum, is an enormous game changer that every company will use,” he replied.

“Weather insurance (Arbol is a great example). With a smart contract I’m soon going to be able to have the Mavs buy weather insurance where using a smart contract I pick the temperature and precipitation thresholds and the smart contract checks the National Weather Service for my ZIP Code or another chosen data source and on that day or period if the threshold is met, I get Ethereum deposited into my account automatically.

“No different than the internet of the 1995 where people weren’t quite sure but eventually they saw the network effect and value. Smart contracts are going to eat a lot of the software-as-a-service world.”

I kept pushing: “I’ve seen complaints about the costs of transactions. Even with Ethereum. Isn’t it still too high, for textbooks certainly, but even for other higher valued items?” Mr. Cuban answered, “It is too expensive. But that’s specific to original Ethereum. There are changes coming with Ethereum 2.0 and immediate options with Layer 2 enhancements from a bunch of companies.”

I noted that Coinbase, now a public company, “is very profitable because their fees are so high but it’s speculators who pay. Won’t lower fees drive usage long term?” “Coinbase is the Netscape of now,” answered Mr. Cuban. “There will be cheaper options.”

I just had to ask. “Does it matter if Ethereum is $3,900 or $39,000 or $390 for that matter for the future you lay out to unfold? There seems a disconnect between how crypto is used for smart contracts and its value.” Mr. Cuban quickly responded, “Doesn’t matter at all.” And that is the bull case for blockchain. Crypto prices? Not so much.

Action Line: Big money will be won and lost on the new frontier; the Gold Rush, television, the Internet, and Bitcoin are old stories. The exciting part to me is how they improve people’s lives, and that’s the discovery worth your attention.

P.S. Other than what someone’s willing to pay you, where does a cryptocurrency’s value come from? Because when it comes to sources of value, with dividends from stocks and interest from bonds, you know where you stand. With cryptos, you hope someone doesn’t jump the line.

When a company pays you a dividend (or a bond pays you interest), it worries about meeting its obligations to you. It sees you, unlike the anonymity of cryptos, banging your tin cup on the boardroom table saying: “Show me the money.”

When a company issues stock, it’s giving up ownership, and with a bond, it’s taking on debt. The company doesn’t care who owns the stocks or bonds—they just want to know where to send the checks.

Your Survival Guy’s noticed how stock and bond prices have been uncharacteristically out of synch for the first time in fifteen years (also pointed out in the WSJ). Investors are worried about inflation. And based on the hubris from the Fed, not everyone’s sure this ship will be docked without a scratch. Make sure your boat isn’t in the way. James Mackintosh reports on those worries in the WSJ, writing:

We saw this last week, with stock prices and bond yields moving in opposite directions every day. The link between the two, measured as the correlation of their daily changes over the past 100 days, is the lowest in more than 15 years. Instead of more inflation being good news for stocks, it is now bad news—while still being bad for bonds, meaning higher yields. Less concern about inflation now means lower Treasury yields, and higher stock prices.

Remember, capital structure is like a channel marker, guiding a company’s financial obligations. As a bondholder, you’re a bosun, senior to the average, stock, deckhand. The capital structure of a crypto? Who owes you anything if the system breaks down? No one.

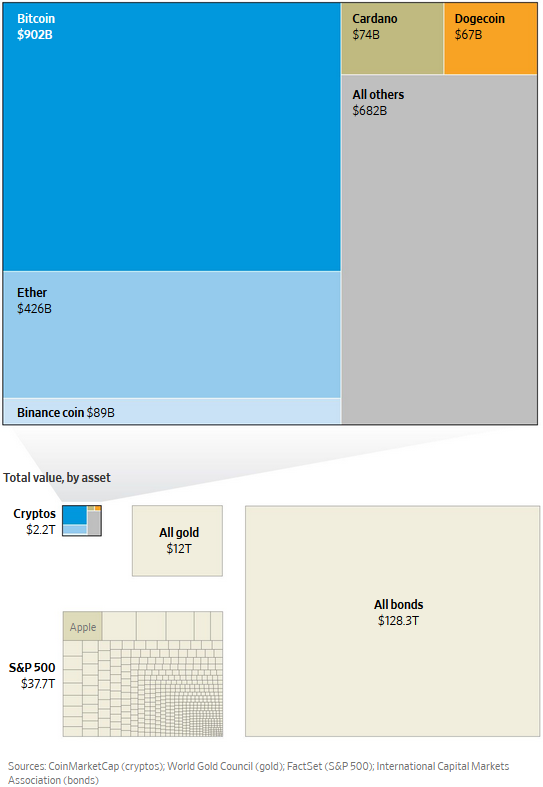

Take a look at the market cap of cryptos, stocks, and bonds, and see why there’s plenty of smart money in bonds. Because at the end of the day, your return to port, like the return of capital, matters more than the return on it.

The Wall Street Journal explains the current situation with cryptocurrencies, writing:

Crypto in Context

Thanks to the prolific rise of bitcoin, ether and dogecoin, the value of the total cryptocurrency market has swelled to more than $2 trillion, up from $260 billion a year ago. Dogecoin alone—with a market value of about $67 billion—is worth more than 75% of the companies listed in the S&P 500. Although the digital currencies have surged in recent months, as an asset class, they remain a fraction of global markets for stocks, bonds and gold.

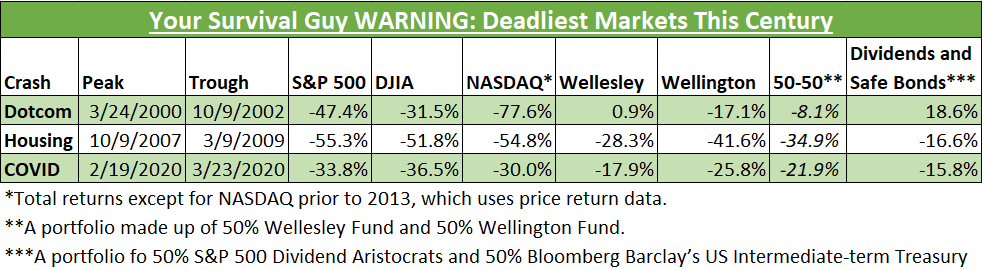

P.S. And remember, we’ve seen some troubling times thrice already this young century.

Originally posted on Your Survival Guy.