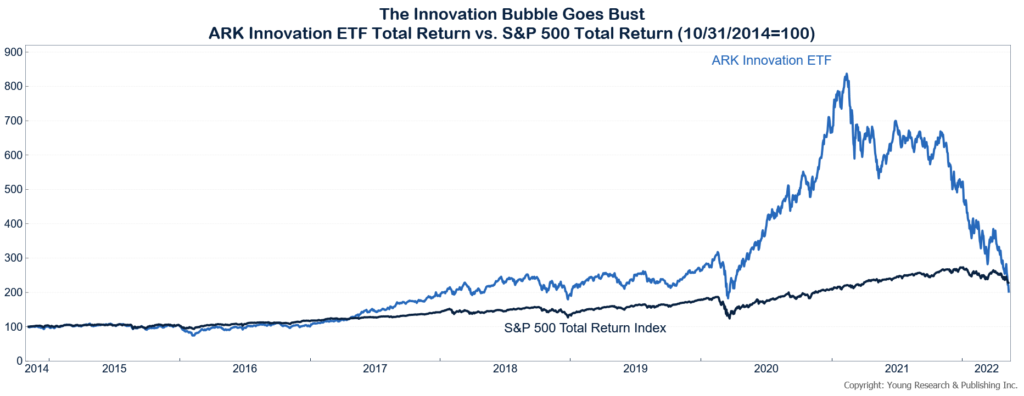

The innovation bubble looks like it has gone bust. The ARK Innovation ETF is down almost 80% from its all-time high. Those are dotcom-type bust numbers. Disruptive technologies that were supposed to change the world have been some of the best performing stocks over the last decade. The hype cycle reached a peak following COVID.

Investors heard for years that this breed of disruptive technology firms was different than the dotcom bubble era companies. Why? Because these stocks had real revenues and real cash flows. We would note, no dividends to speak of, but yes there was real revenue and real cash flow. And there is no question some of these firms may in fact change the world and disrupt existing industries, but, as it turns out, price matters.

Since its inception in October of 2014, the ARK ETF is now trailing the S&P 500.