All is not lost in a downward moving market, especially as interest rates rise. One way to think about your portfolio is to look at it over a period of, say, 15 years. What’s your 15-year plan? Can you survive another three years like this one? How about the last three years? They weren’t too bad.

Thinking over a 15-year period might not be as hard as you think. The last 15 included a real bruising time during the financial crisis (I hope you didn’t sell). Prices go up, and prices go down—dividends and interest rates do too, especially in times like these, and that’s a good thing. Today we’re seeing a great reset, if you will, with both rising.

If you can hang in there, and I know many of you are, then you simply need to be patient and be a collector of money, not a reckless speculator hanging on to prices for dear life. You probably didn’t do that with the price of your home where you raised your family. You didn’t say, “Well, kids, the house just lost ten percent of its value, and I’m thinking of selling. Pack your bags.” No, you were patient because you had to be.

You made the mortgage payments, kept your head down, and you worked at your profession. You focused on my number one investment: YOU. Why not do the same with your precious retirement savings. Keep reinvesting or take the income. Don’t lose sleep over prices. I don’t lose sleep over how long this will last. Focus on what you can control: YOU. Easy, yet hard to do.

Action Line: Do you have a 15-year plan? Let’s talk.

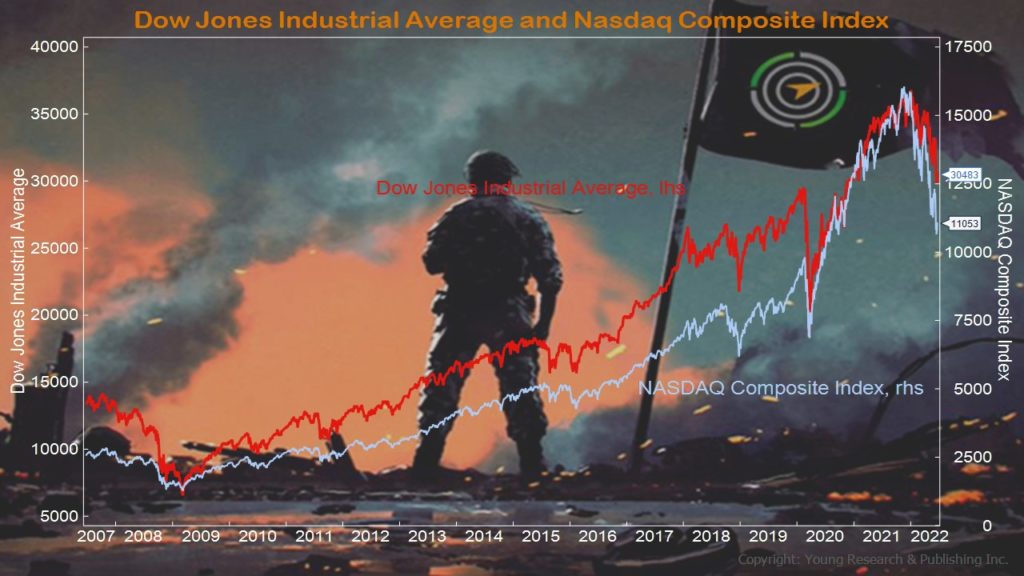

P.S. Here’s the last 15 years of performance for the Dow Jones Industrial Average and the NASDAQ Composite Index.

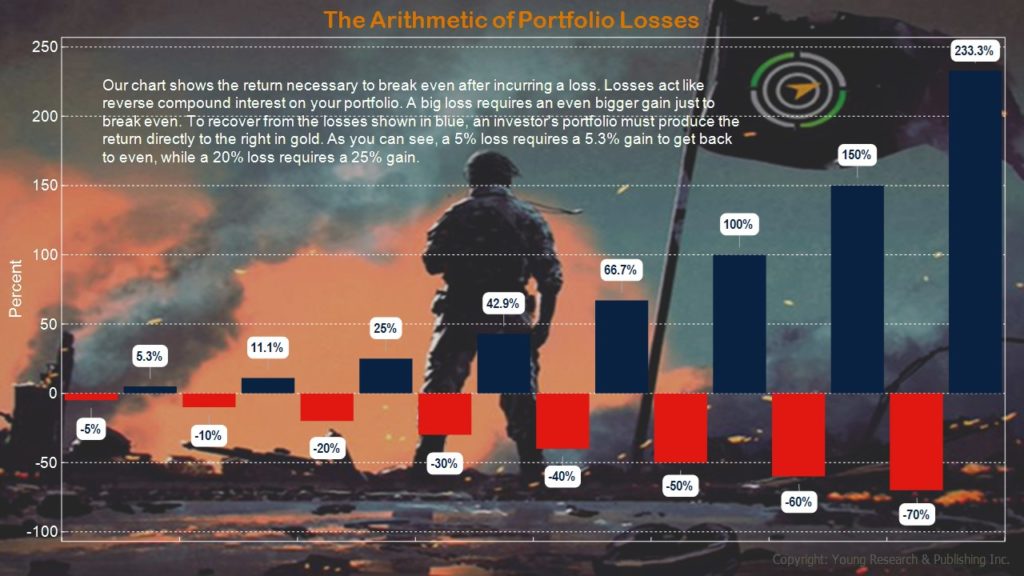

P.P.S. If you sold out at any one of the most recent dips in the market, and locked in those losses right before the market rallied, it is going to take a long time to recover. Take a look at my Arithmetic of Portfolio Losses chart for an idea of how difficult it is to come back from a big loss.

P.P.P.S. Slow and steady wins the race.

Originally posted on Your Survival Guy.